Chapter 39 Imbalanced Data

Classification with imbalanced data is characterized by the uneven proportion of cases that are available for each class, and causes problems in many learning algorithms. An imbalance in the data is usually considered an issue when the distribution of classes is skewed more than 60-40% ratio.

There are two simple methods to overcome imbalance data in classification problems: oversampling and undersampling, both of which are used to adjust the class distribution in a data set. While oversampling simply randomly replicates the minority class, undersampling randomly selects a subset of majority class and reduces the overall sample size. Thus, it can discard useful data.

There are also more complex oversampling techniques, including the creation of artificial data points. The most common technique is known as SMOTE, Synthetic Minority Oversampling Technique (2002). This method generates synthetic data based on the feature space similarities between existing minority instances. In order to create a synthetic instance, it finds the k-nearest neighbors of each minority instance, randomly selects one of them, and then calculate linear interpolations to produce a new minority instance in the neighborhood.

The other methods is the adaptive synthetic sampling approach (ADASYN), which builds on the methodology of SMOTE, by shifting the importance of the classification boundary to those minority classes.

In this chapter we will see some examples using only SMOTE.

39.1 SMOTE

We will use Credit Card Fraud Detection dataset on Kaggle. The dataset has about 300K anonymized credit card transfers labeled as fraudulent or genuine. The features are numerical and anonymized (V1, V2, … , V28). They are the principal components obtained with principal component analysis (PCA). The only features which have not been transformed with PCA are Time and Amount. Feature Time contains the seconds elapsed between each transaction and the first transaction in the dataset. The feature Amount is the transaction Amount and Class is the response variable and it takes value 1 in case of fraud and 0 otherwise.

The prediction problem is to label transactions as fraud or not. We will use only a subset of data with roughly 10K observations, representing transactions.

library(tidyverse)

library(ROCR)

library(smotefamily)

library(randomForest)

head(creditcard10)## # A tibble: 6 × 31

## Time V1 V2 V3 V4 V5 V6 V7 V8 V9

## <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl>

## 1 77319 -0.278 0.924 1.40 0.833 0.0318 -0.619 0.592 0.0361 -0.751

## 2 130219 0.916 -2.70 -3.26 -0.00660 -0.504 -1.14 1.26 -0.609 -1.18

## 3 42328 -2.25 -1.03 0.937 0.198 1.01 -2.00 -0.754 0.691 -0.423

## 4 51453 -0.386 0.766 0.850 0.195 0.850 0.188 0.702 0.0700 0.0516

## 5 48711 -1.04 0.240 1.53 -0.0509 1.80 0.650 0.556 0.172 -0.288

## 6 125697 1.52 -1.92 -2.33 -0.586 -0.468 -0.837 0.387 -0.440 -0.456

## # … with 21 more variables: V10 <dbl>, V11 <dbl>, V12 <dbl>, V13 <dbl>,

## # V14 <dbl>, V15 <dbl>, V16 <dbl>, V17 <dbl>, V18 <dbl>, V19 <dbl>,

## # V20 <dbl>, V21 <dbl>, V22 <dbl>, V23 <dbl>, V24 <dbl>, V25 <dbl>,

## # V26 <dbl>, V27 <dbl>, V28 <dbl>, Amount <dbl>, Class <dbl>table(creditcard10$Class)##

## 0 1

## 28427 53prop.table(table(creditcard10$Class))##

## 0 1

## 0.998139045 0.001860955The class balance is way off! The split is approximately 99.83% to 0.017%.

df <- creditcard10

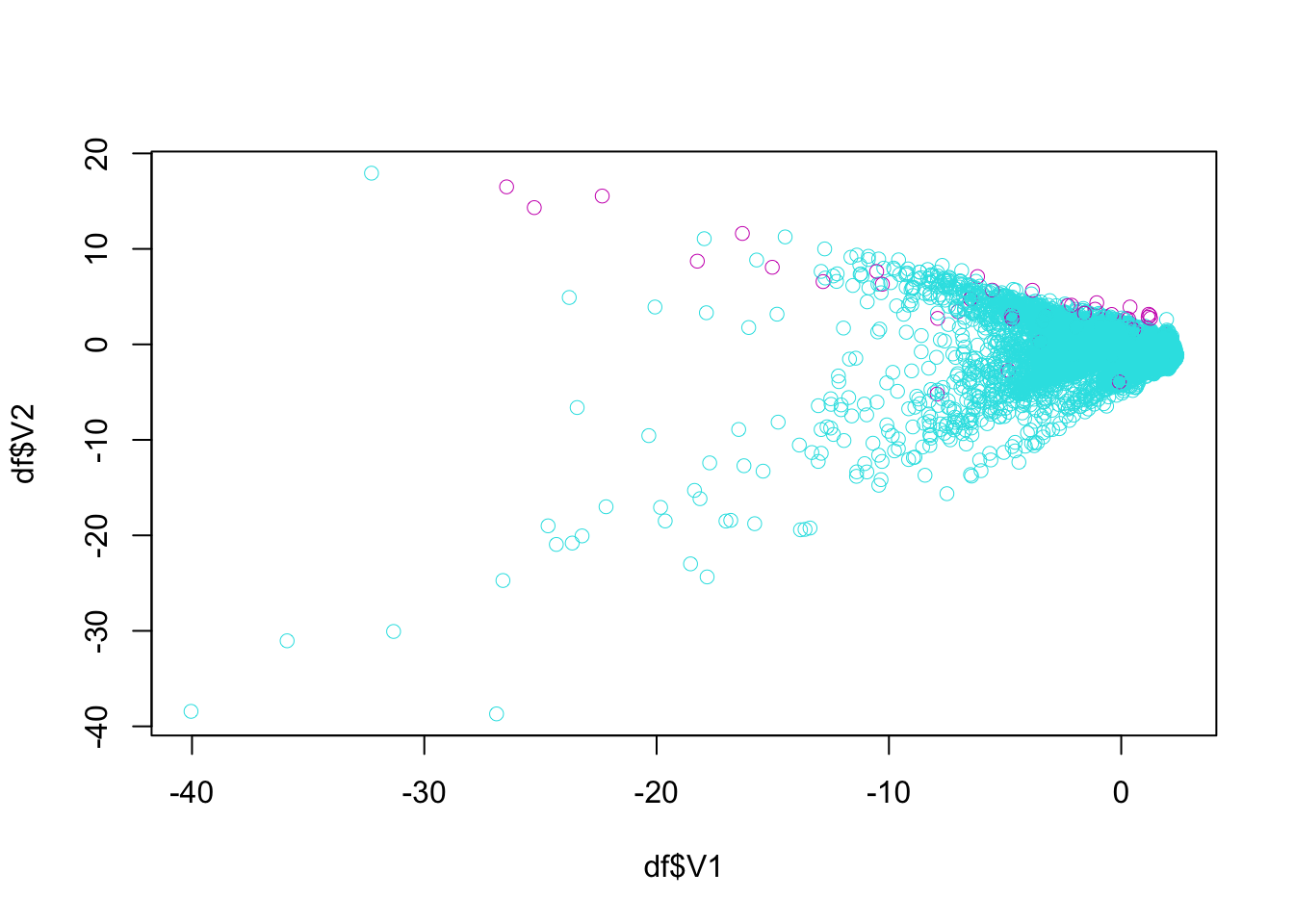

plot(df$V1, df$V2, col = (df$Class+1) + 4, lwd = 0.5)

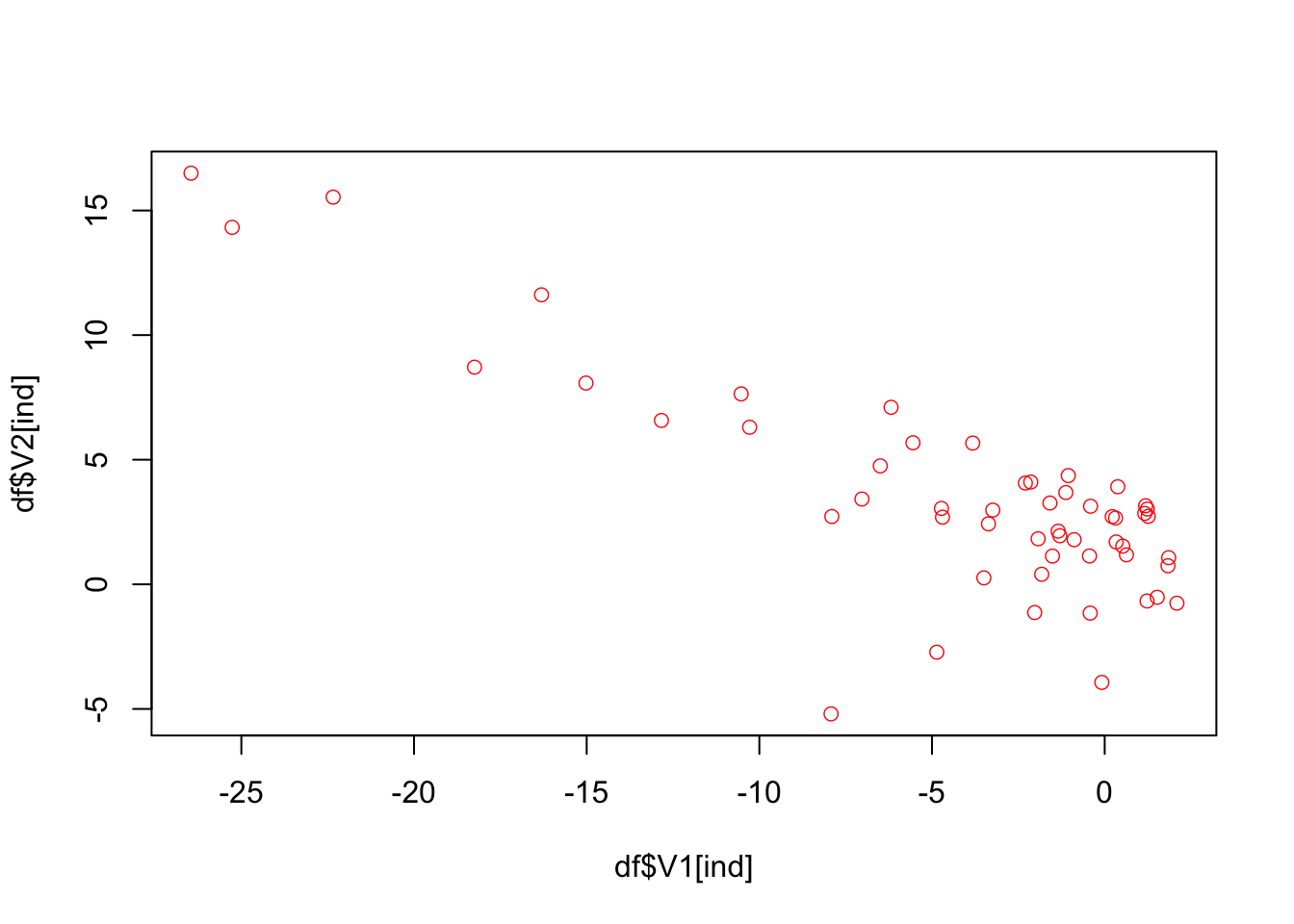

ind <- which(df$Class == 1, arr.ind = TRUE)

plot(df$V1[ind], df$V2[ind], col = "red", lwd = 0.7)

The idea behind SMOTE is very simple: take a red point (fraud) say Jason, find the k nearest neighbors to Jason by using all features. Then we randomly pick one observation among these, let’s say, 5 neighbors. Suppose that person is Mervin. Now, also suppose that we have only two features: V1 and V2

| Observations | V1 | V2 |

|---|---|---|

| Jason | -12.5 | -5.0 |

| Mervin | -10.5 | -2.5 |

Then the new synthetic point will be created by \(V1 = -12.5 + r(-10.5-(-12.5)) = -12.5 +r2.0\) and \(V2 = -5 + r(-2.5-(-5)) = -5 +r2.5\), where \(r\) is a random number between 0 and 1. If it’s 0.7, for example, the new synthetic observation will be added to data:

| Observations | V1 | V2 |

|---|---|---|

| Jason | -12.5 | -5.0 |

| Mervin | -10.5 | -2.5 |

| Synthetic | -11.1 | -3.25 |

This is one synthetic observation created form a real observation, Tim. We can repeat it 10, 20 times and create many synthetic observations from Tim. And then we can repeat it for each real cases of fraud.

library(smotefamily)

df$Class <- as.factor(df$Class)

outc <- SMOTE(X = df[, -31], target = df$Class, K = 4, dup_size = 10)

over_df = outc$data

table(over_df$class)##

## 0 1

## 28427 583prop.table(table(over_df$class))##

## 0 1

## 0.97990348 0.02009652Or, with higher K and dup_size:

library(smotefamily)

df$Class <- as.factor(df$Class)

outc <- SMOTE(X = df[, -31], target = df$Class, K = 4, dup_size = 50)

over_df = outc$data

table(over_df$class)##

## 0 1

## 28427 2703prop.table(table(over_df$class))##

## 0 1

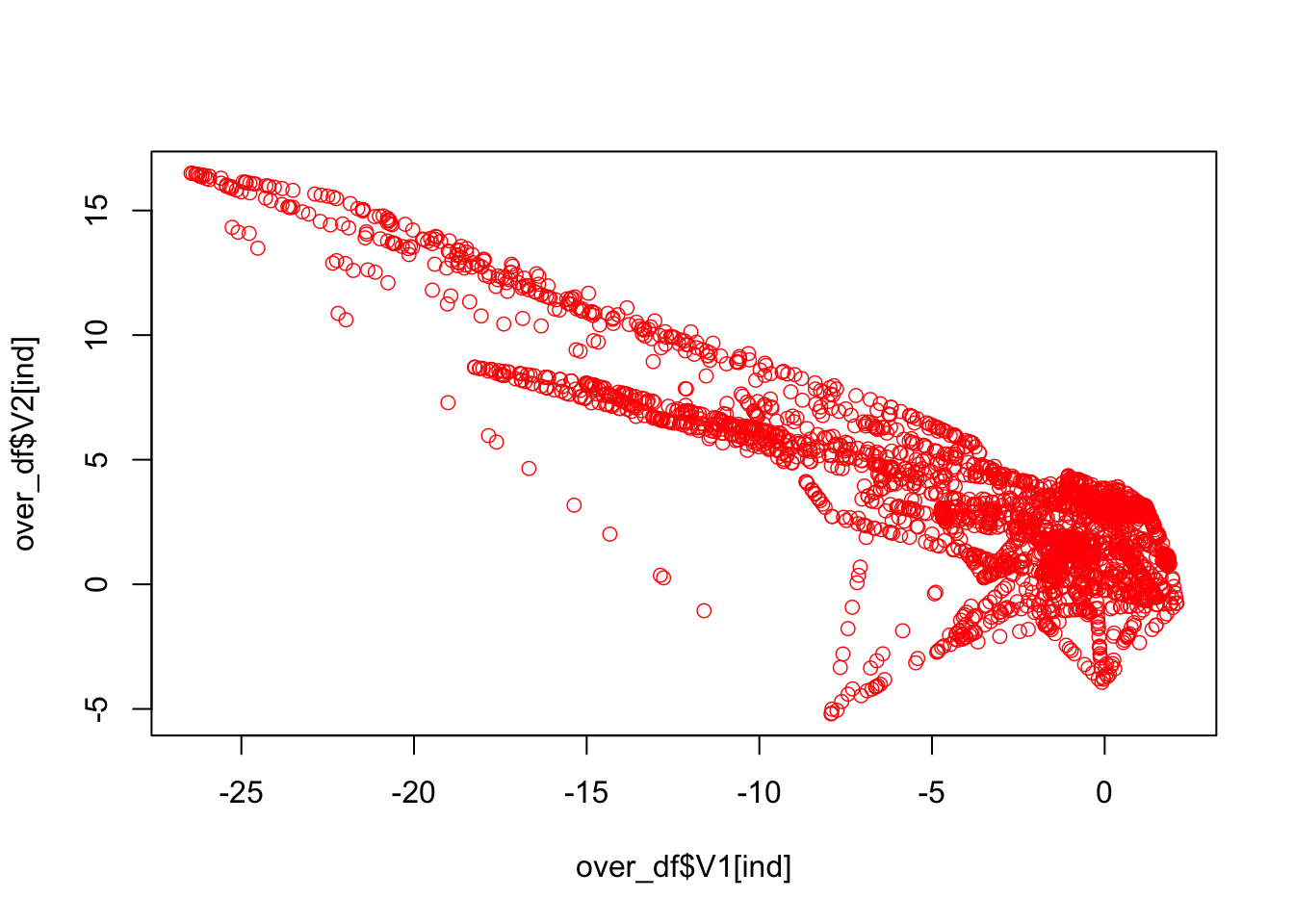

## 0.91317058 0.08682942And, here is the new plot with expanded “fraud” cases:

ind <- which(over_df$class == 1, arr.ind = TRUE)

plot(over_df$V1[ind], over_df$V2[ind], col = "red", lwd = 0.7)

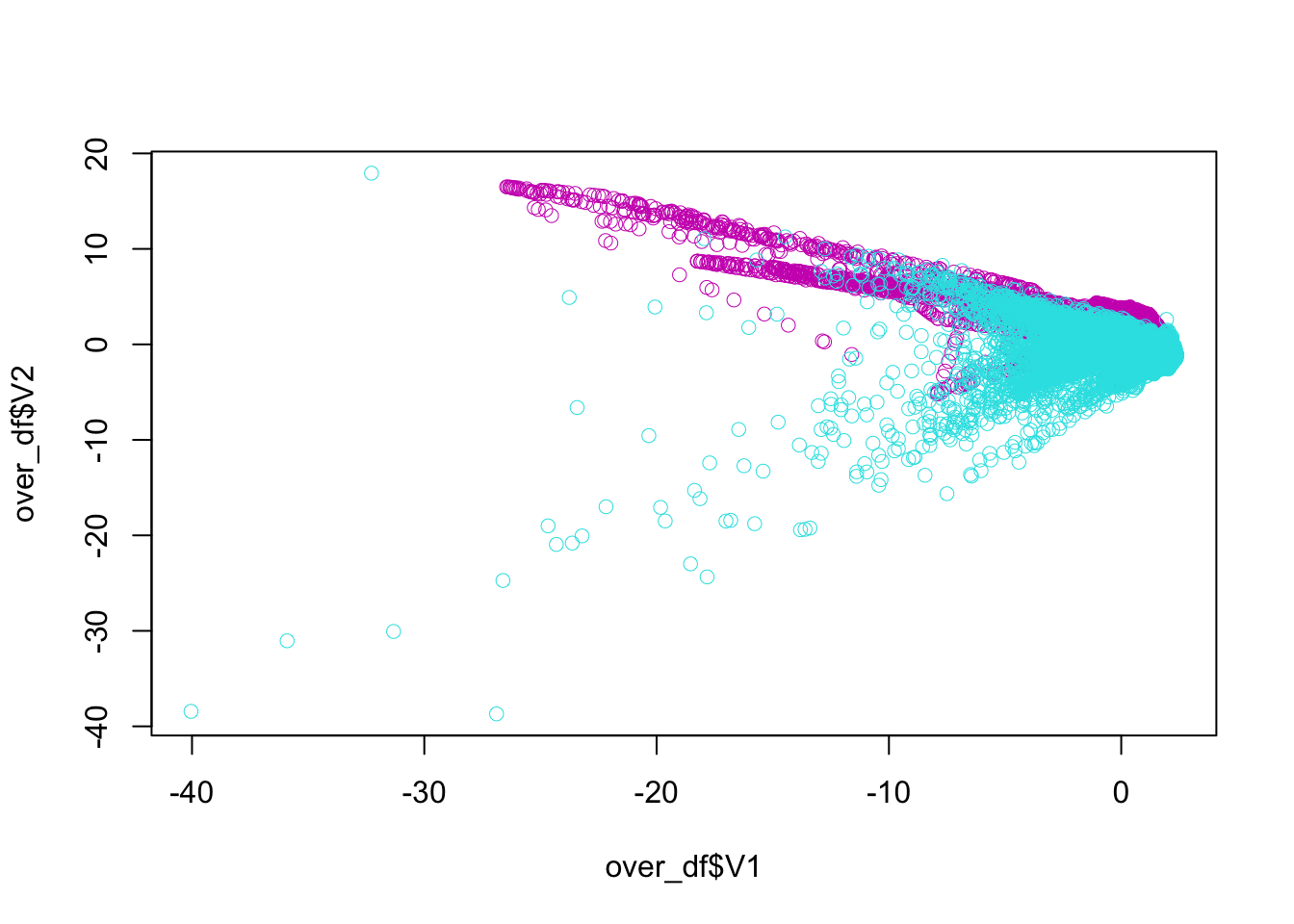

All together:

plot(over_df$V1, over_df$V2, col = (as.numeric(over_df$class)+1) + 4, lwd = 0.5)

39.2 Fraud detection

Here is what we will do with the fraud data in the following script:

- Apply

SMOTEon training set to balance the class distribution - Train a Random Forest model on re-balanced training set

- Test performance on (original) test set

In addition, we will compare with and without balancing.

library(ROCR)

library(smotefamily)

library(randomForest)

rm(list = ls())

load("creditcard10.RData")

df$Class <- as.factor(df$Class)

AUCb <- c()

AUCimb <- c()

n = 10 # Could be 50, since the data is large for RF

B = 100

for (i in 1:n) {

set.seed(i)

ind <- sample(nrow(df), nrow(df), replace = TRUE)

ind <- unique(ind) # Otherwise it oversamples 0's

train <- df[ind, ]

test <- df[-ind, ]

# Balancing

outdf <- SMOTE(X = train[, -31], target = train$Class, K = 10, dup_size = 50)

trainn <- outdf$data

trainn$class <- as.factor(trainn$class) #SMOTE makes factor to "chr"!

colnames(trainn)[31] <- "Class" #SMOTE made it lower case!

modelb <- randomForest(Class~., ntree = B, data = trainn)

phatb <- predict(modelb, test, type = "prob")

# Without Balancing

modelimb <- randomForest(Class~., ntree = B, data = train)

phatimb <- predict(modelimb, test, type = "prob")

#AUCb

pred_rocr1 <- prediction(phatb[,2], test$Class)

auc_ROCR1 <- performance(pred_rocr1, measure = "auc")

AUCb[i] <- auc_ROCR1@y.values[[1]]

#AUCimb

pred_rocr1 <- prediction(phatimb[,2], test$Class)

auc_ROCR1 <- performance(pred_rocr1, measure = "auc")

AUCimb[i] <- auc_ROCR1@y.values[[1]]

}

model <- c("Balanced", "Imbalanced")

AUCs <- c(mean(AUCb), mean(AUCimb))

sd <- c(sqrt(var(AUCb)), sqrt(var(AUCimb)))

data.frame(model, AUCs, sd)## model AUCs sd

## 1 Balanced 0.9682024 0.02968400

## 2 Imbalanced 0.9340113 0.03698929Our results show improved AUC results and lower sd for our model built on the balanced data.