Chapter 31 ARIMA models

ARIMA (Autoregressive Integrated Moving Average) is a statistical model for time series forecasting. It is a type of linear model that can be used to analyze and forecast data that exhibits temporal dependencies, such as seasonality and autocorrelation. The model is comprised of three components:

- Autoregressive (AR) component: This component models the dependencies between the current value of the time series and the past values.

- Integrated (I) component: This component component refers to the degree of differencing that is applied to the time series data. The degree of differencing is the number of times that the data is differenced in order to make it stationary meaning that the mean, variance, and covariance are constant over time.

- Moving average (MA) component: This component models the dependencies between the current value of the time series and the past forecast errors. The moving average component of an ARIMA model is used to capture the short-term fluctuations in the time series data that are not captured by the autoregressive component. For example, if the time series data exhibits random noise or sudden spikes, the moving average component can help to smooth out these fluctuations and improve the forecast accuracy.

The ARIMA model can be written as ARIMA(p,d,q), where p is the order of the autoregressive component, d is the degree of differencing, and q is the order of the moving average component. The values of p, d, and q are chosen based on the characteristics of the time series data and the desired level of forecasting accuracy.

To use the ARIMA model, the time series data must first be preprocessed to remove any trend and seasonality, and to ensure that the data is stationary (meaning that the mean and variance are constant over time). The model is then fit to the preprocessed data, and forecasts are generated based on the fitted model. ARIMA models can be used to make point forecasts (predictions for a specific time point) or interval forecasts (predictions with a range of possible values).

The mathematical foundation of the ARIMA model is based on the concept of autoregressive (AR) and moving average (MA) processes. An autoregressive process is a type of stochastic process in which the current value of a time series depends on a linear combination of past values of the series. An autoregressive process can be represented mathematically as:

\[ X_{t} = c + \sum_{i=1}^{p}(\phi_{i} X_{t-i}) + \epsilon_{t}, \]

where \(X_{t}\) is the value of the time series at time \(t\), \(c\) is a constant, \(\phi_{i}\) is the autoregressive coefficient for lag \(i\), and \(\epsilon_{t}\) is white noise (a sequence of random variables with a mean of zero and a constant variance).

A moving average process is a type of stochastic process in which the current value of a time series depends on a linear combination of past errors or residuals (the difference between the actual value and the forecasted value). A moving average process can be represented mathematically as:

\[ X_{t} = c + \sum_{i=1}^{q}(\theta_{i} \epsilon_{t-i}) + \epsilon_{t}, \]

where \(\theta_{i}\) is the moving average coefficient for lag \(i\), and $ _{t}$ is again white noise.

The ARIMA model is a combination of an autoregressive process and a moving average process. It can be represented mathematically as:

\[ X_{t} = c + \sum_{i=1}^{p}(\phi_{i} X_{t-i}) + \sum_{i=1}^{q}(\theta_{i} \epsilon_{t-i}) + \epsilon_{t} \]

It is possible to write any stationary \(\operatorname{AR}(p)\) model as an MA(\(\infty\)) model by using repeated substitution. Here is the example for an \(\mathrm{AR}(1)\) model without a constant:

\[ X_{t} = \phi_{1} X_{t-1} + \epsilon_{t} ~~~ \text{and} ~~~ X_{t-1} = \phi_{1} X_{t-2} + \epsilon_{t-1}\\ X_{t}=\phi_1\left(\phi_1 X_{t-2}+\epsilon_{t-1}\right)+\epsilon_t\\ =\phi_1^2 X_{t-2}+\phi_1 \epsilon_{t-1}+\epsilon_t\\ =\phi_1^3 X_{t-3}+\phi_1^2 \epsilon_{t-2}+\phi_1 \epsilon_{t-1}+\epsilon_t\\ \vdots \]

With \(-1<\phi_1<1\), the value of \(\phi_1^k\) will get smaller as \(k\) gets bigger. Therefore, \(\mathrm{AR}(1)\) becomes an MA \((\infty)\) process:

\[ X_t=\epsilon_t+\phi_1 \epsilon_{t-1}+\phi_1^2 \epsilon_{t-2}+\phi_1^3 \epsilon_{t-3}+\cdots, \] The parameters of the ARIMA model (\(c\), \(\phi_{i}\), \(\theta_{i}\)) are estimated using maximum likelihood estimation (MLE), which involves finding the values of the parameters that maximize the likelihood of the observed data given the model. Once the model has been fit to the data, it can be used to make point forecasts (predictions for a specific time point) or interval forecasts (predictions with a range of possible values).

In the ARIMA(p,d,q), the order of the autoregressive component (p) is the number of past values that are used to predict the current value of the time series, and the order of the moving average component (q) is the number of past errors or residuals that are used to predict the current value of the time series. Some common methods for selecting p and q include:

- Autocorrelation function (ACF) plot: This plot shows the correlations between the time series data and lagged versions of itself. A high positive autocorrelation at a lag of p suggests that p may be a good value for p.

- Partial autocorrelation function (PACF) plot: This plot shows the correlations between the time series data and lagged versions of itself, after accounting for the correlations at all lower lags. A high positive autocorrelation at a lag of q suggests that q may be a good value for q.

- Information criteria: There are several statistical measures that can be used to compare the goodness of fit of different ARIMA models, such as Akaike’s Information Criterion (AIC) and the Bayesian Information Criterion (BIC). These measures can be used to select the model with the lowest value, which is generally considered to be the best model.

It’s important to note that determining the values of p and q is an iterative process, and you may need to try different values and evaluate the results in order to find the best fit for your data.

31.1 Hyndman-Khandakar algorithm

The Hyndman-Khandakar algorithm (Hyndman & Khandakar, 2008) combines several steps for modeling (and estimation) of the ARIMA model: unit root tests, minimization of the AICc, and MLE to obtain an ARIMA model. The arguments to ARIMA() in the fable package provide for many variations for modeling ARIMA. The modeling procedure to a set of (non-seasonal) time series data for ARIMA is defined in FPP3 as follows:

- Plot the data to identify any outliers.

- If the data shows variation that increases or decreases with the level of the series, transform the data (Box-Cox transformation) to stabilize the variance.

- Check if the data are non-stationary. And, make them stationary, if they are not.

- Start with an ARIMA \((p, d, 0)\) or ARIMA \((0, d, q)\) depending of what ACF/PACF indicates.

- Try your chosen model(s), and use the AICc to search for a better model.

However, after step 5, the residuals from the chosen model are supposed to be white noise. Otherwise, the model has to be modified. Once the residuals look like white noise, the ARIMA model is ready for forecasting.

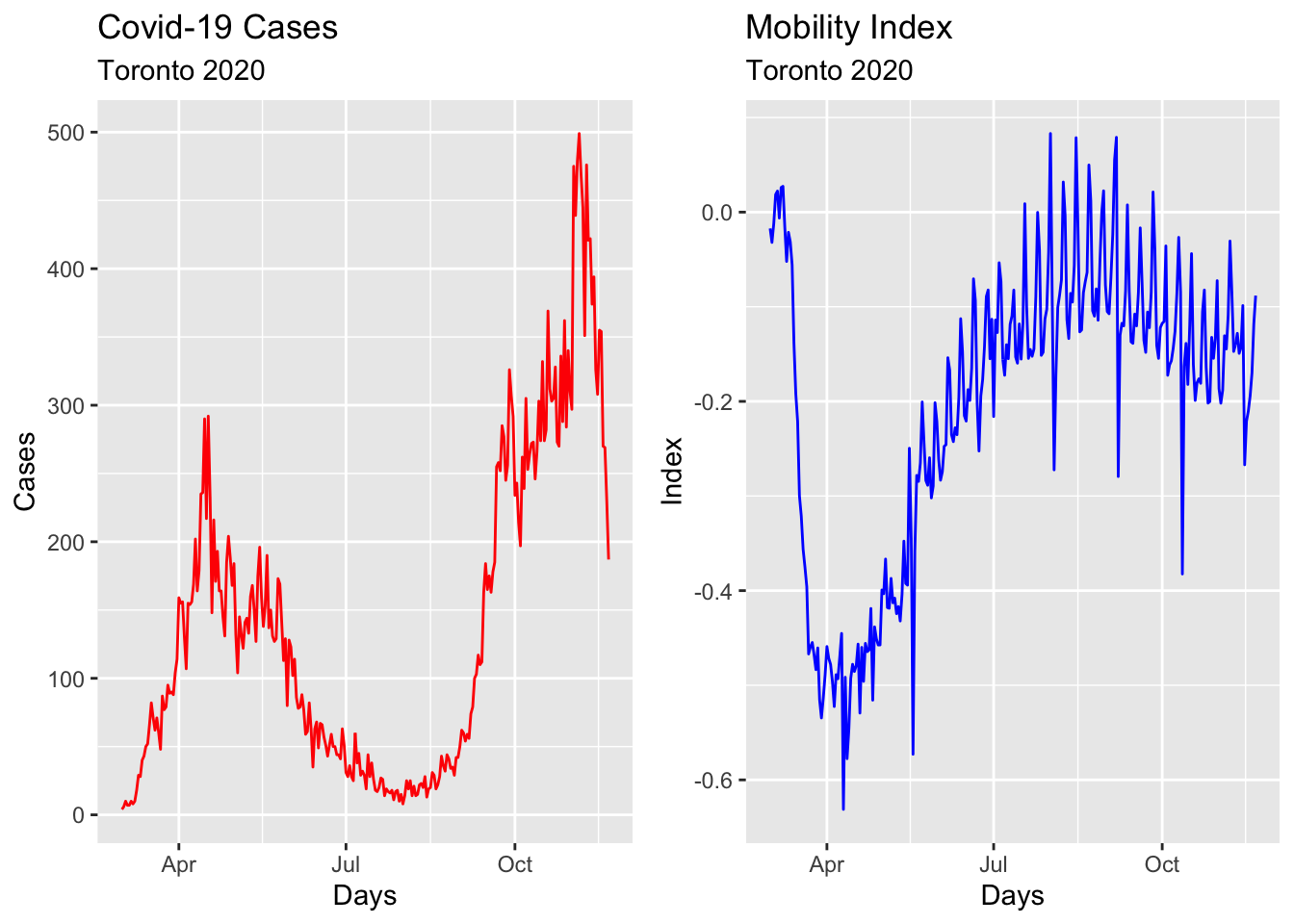

We will show all these steps by using the epidemic curve of COVID-19 in Toronto covering 266 days between the March \(1^{st}\) and the November \(21^{st}\) of 2020. An epidemic curve (or epi curve) is a visual display of the onset of illness among cases associated with an outbreak. The data contain the first wave and the first part of the second wave. It is from Ontario Data Catalogue sorted by Episode Date, which is the date when the first symptoms were started. Our data set also contains the mobility data is from Facebook, all_day_bing_tiles_visited_relative_change, which is reflects positive or negative change in movement relative to baseline.

31.2 TS Plots

Let’s first load the data and convert it to tsibble, which can be:

library(tsibble)

library(fpp3)

load("~/Dropbox/ToolShed_draft/dftoronto.RData")

day <- seq.Date(from = as.Date("2020/03/01"),

to = as.Date("2020/11/21"), by = 1)

tdata <- tibble(Day = day, mob = data$mob, cases = data$cases)

toronto <- tdata %>%

as_tsibble(index = Day)

toronto## # A tsibble: 266 x 3 [1D]

## Day mob cases

## <date> <dbl> <dbl>

## 1 2020-03-01 -0.0172 4

## 2 2020-03-02 -0.0320 6

## 3 2020-03-03 -0.0119 10

## 4 2020-03-04 0.0186 7

## 5 2020-03-05 0.0223 7

## 6 2020-03-06 -0.00626 10

## 7 2020-03-07 0.0261 8

## 8 2020-03-08 0.0273 10

## 9 2020-03-09 -0.0158 18

## 10 2020-03-10 -0.0521 29

## # … with 256 more rowsNote the [1D] in the header indicating this is daily data. Dealing with daily and sub-daily data with ts class is not an easy process. The tsibble class handles such data with no problem. More details on tsibbles can be found at Tidy time series data using tsibbles. Although there are better plotting option cosmetically, we will stick to applications in what fpp3 simply offers:

a <- toronto %>% autoplot(mob, col = 'blue') +

labs(

title = "Mobility Index",

subtitle = "Toronto 2020",

x = "Days",

y = "Index"

)

b <- toronto %>% autoplot(cases, col = 'red') +

labs(

title = "Covid-19 Cases",

subtitle = "Toronto 2020",

x = "Days",

y = "Cases"

)

require(gridExtra)

grid.arrange(b, a, ncol=2)

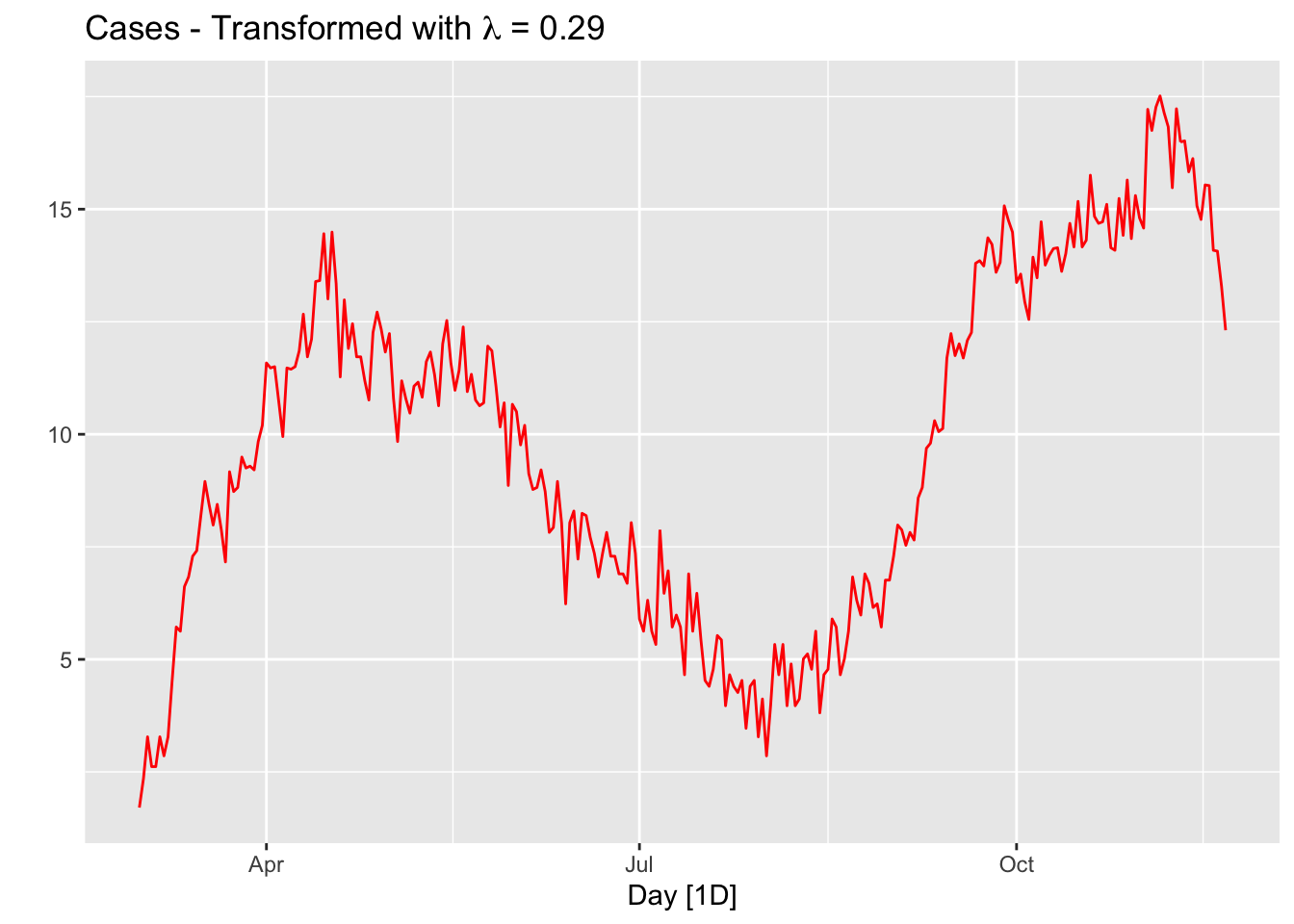

31.3 Box-Cox transformation

There are different ways to transform the data, which make the size of the variation about the same across the whole series. A proper variance-stabilizing transformation makes the forecasting model simpler and better. For example, Proietti and Lutkepohl (2012) find that the Box–Cox transformation produces forecasts which are significantly better than the untransformed data at the one-step-ahead horizon (See Does the Box–Cox transformation help in forecasting macroeconomic time series?).

lmbd <- toronto %>%

features(cases, features = guerrero) %>%

pull(lambda_guerrero)

toronto %>%

autoplot(box_cox(cases, lambda = lmbd), col = "red") +

labs(y = "",

title = latex2exp::TeX(paste0(

"Cases - Transformed with $\\lambda$ = ",

round(lmbd,2))))

The option guerrero computes the optimal \(\lambda\) value for a Box-Cox transformation using the Guerrero method. We should also have a transformation that converts the case numbers to a “positivity rate”, which is the percentage of positive results in all COVID-19 tests applied on a given day. We ignore this transformation for now, but the number of tests performed in a given day changes the numbers of cases.

31.4 Stationarity

A time series is stationary if a shift in time does not cause a change in the shape of the distribution, like the mean, variance, and covariance. Stationarity is an important assumption in many time series forecasting methods, because the patterns and trends in the data can be modeled effectively. If a time series is not stationary, it can lead to inaccurate or unreliable forecasts. This is because non-stationary data has statistical properties that change over time making the current patterns and trends ungeneralizable for the future.

There are several tests that can be used to determine whether a time series is stationary or not, including the Dickey-Fuller test and the KPSS (Kwiatkowski-Phillips-Schmidt-Shin) test. If a time series is found to be non-stationary, it may be necessary to transform the data in some way before applying a forecasting method in order to obtain reliable forecasts. The main method is differencing, which involves taking the difference between consecutive values in the series.

Let’s first formally test all these series and see what we get:

# number of first differences

toronto %>%

features(cases, unitroot_ndiffs)## # A tibble: 1 × 1

## ndiffs

## <int>

## 1 1# Formal KPSS test on level

toronto %>%

features(cases, unitroot_kpss)## # A tibble: 1 × 2

## kpss_stat kpss_pvalue

## <dbl> <dbl>

## 1 1.61 0.01# Formal KPSS test on the first difference

toronto %>%

mutate(diffcases = difference(cases)) %>%

features(diffcases, unitroot_kpss)## # A tibble: 1 × 2

## kpss_stat kpss_pvalue

## <dbl> <dbl>

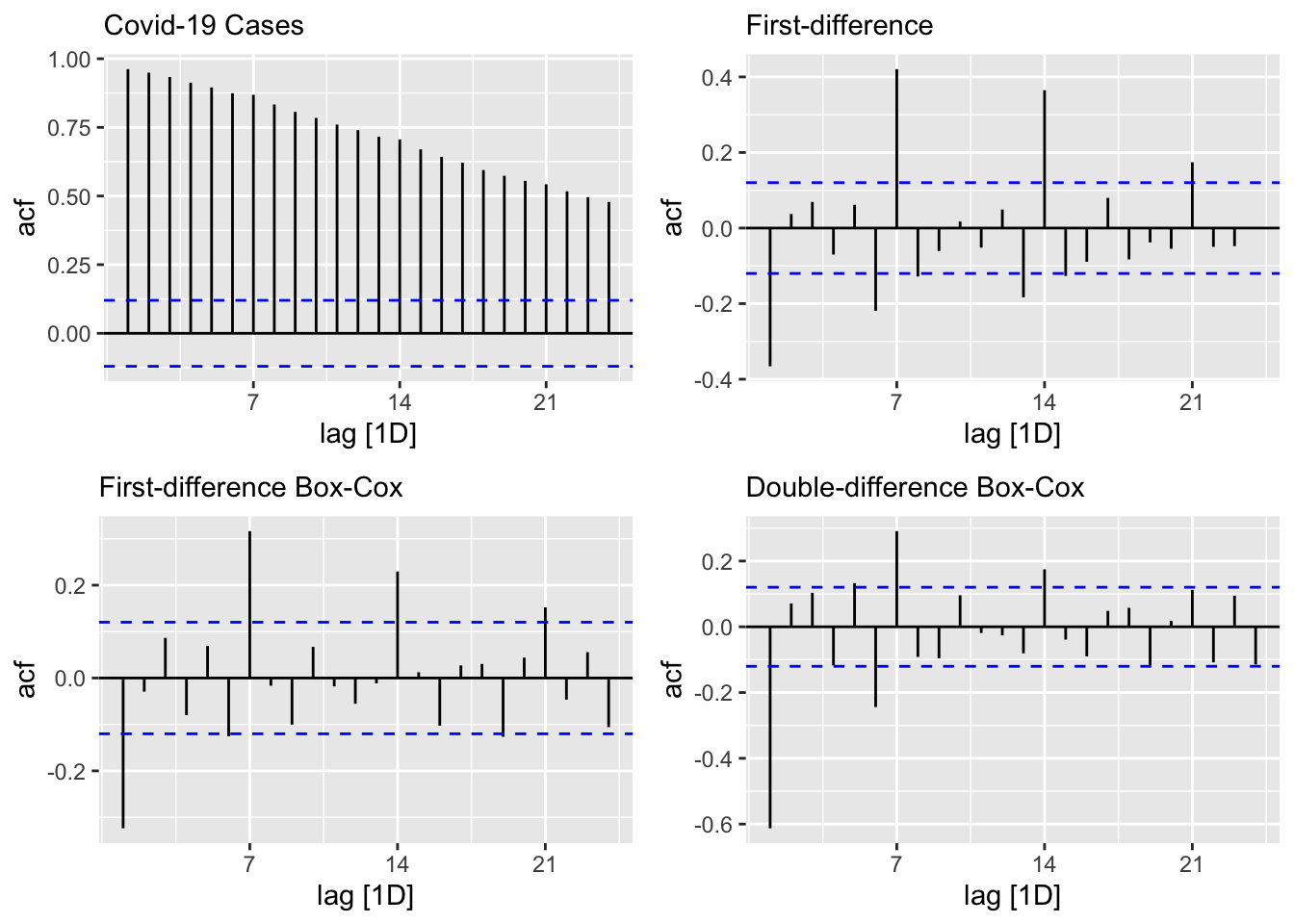

## 1 0.0970 0.1It seems that the first difference can make the cases series stationary. The null in this test is taht the series are stationary. So, the p-value indicates that the null is rejected. So, it seems that the test after first differencing gives us a green light! However, ACF’s are telling us that seasonal differencing would be needed:

level <- toronto %>% ACF(cases) %>%

autoplot() + labs(subtitle = "Covid-19 Cases")

fdiff <- toronto %>% ACF(difference(cases)) %>%

autoplot() + labs(subtitle = "First-difference")

diffbc <- toronto %>% ACF(difference(box_cox(cases, lmbd))) %>%

autoplot() + labs(subtitle = "First-difference Box-Cox")

ddiff <- toronto %>% ACF(difference(difference(box_cox(cases, lmbd)))) %>%

autoplot() + labs(subtitle = "Double-difference Box-Cox")

require(gridExtra)

grid.arrange(level, fdiff, diffbc, ddiff, ncol = 2, nrow =2)

From ACF’s, there seems to be a weekly seasonal pattern at 7, 14, and 21, which are Sundays: reported Covid-19 cases on Sundays tend to be lower than the rest of the week at least for during the first wave.

We can also test if we need seasonal differencing:

toronto %>%

features(cases, unitroot_nsdiffs)## # A tibble: 1 × 1

## nsdiffs

## <int>

## 1 0# with Box-Cox

toronto %>%

features(box_cox(cases, lmbd), unitroot_nsdiffs)## # A tibble: 1 × 1

## nsdiffs

## <int>

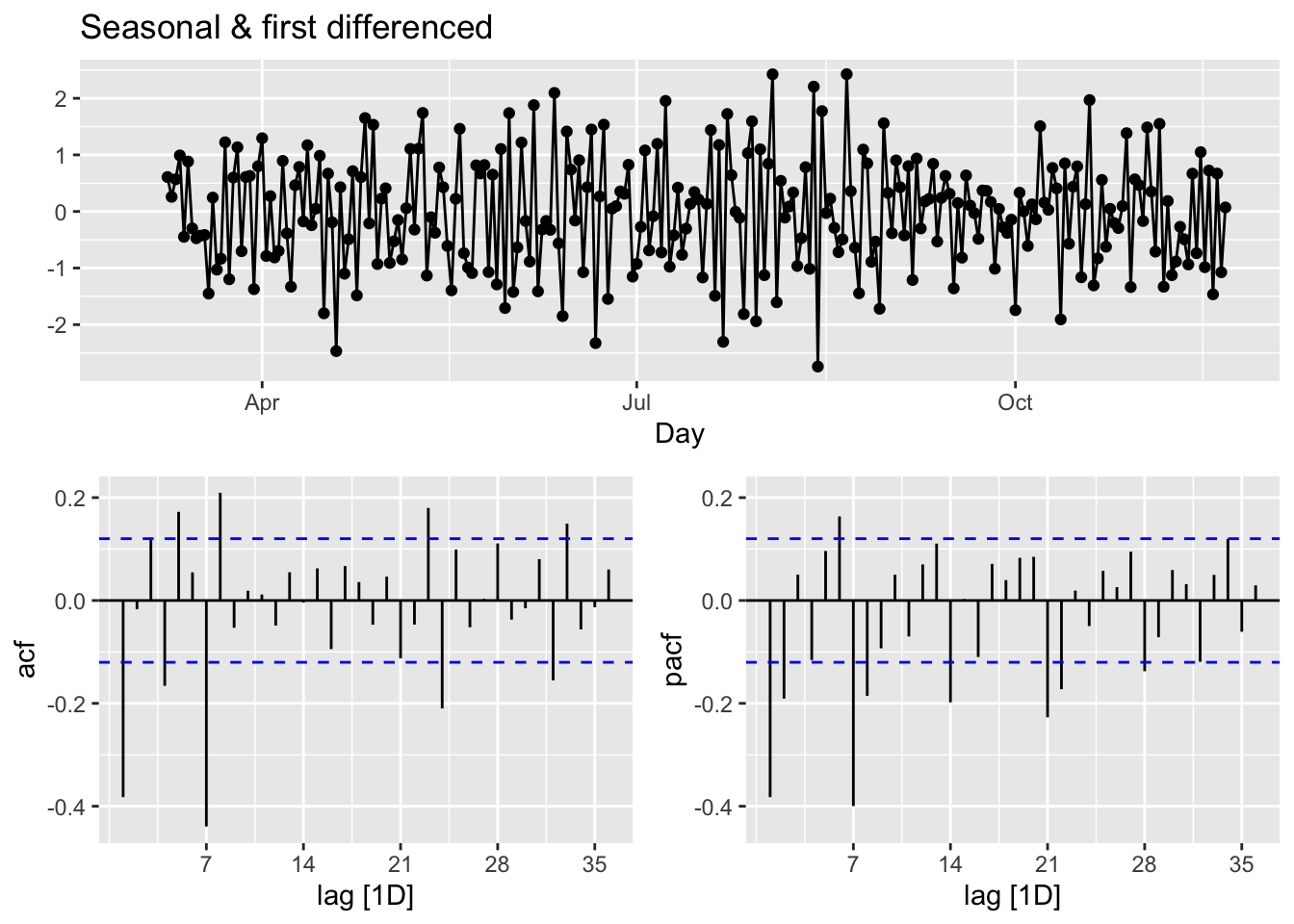

## 1 0The feature unitroot_nsdiffs returns 0 for both original and transformed series indicating no seasonal difference is required. We will stick to this “advice” because of two reasons: first, an unnecessary differencing would create more problems than a solution;, second, we can also modify ARIMA to incorporate seasonalllty in the data, which we will see shortly . However, out of curiosity, let’s remove the “seemingly” weekly seasonality and see what happens to ACF’s. Since, the order of differencing is not important, we first applied the seasonal differencing then applied the first difference:

toronto %>%

gg_tsdisplay(difference(box_cox(cases, lmbd), 7) %>% difference(),

plot_type='partial', lag=36) +

labs(title = "Seasonal & first differenced", y="")

We can calculate the strength of the trend (T) and seasonality (S) in the time series, \(y_t=T_t+S_t+R_t\), by

\[ F_{Trend}=\max \left(0,1-\frac{\operatorname{Var}\left(R_t\right)}{\operatorname{Var}\left(T_t+R_t\right)}\right),\\ F_{Seasonality}=\max \left(0,1-\frac{\operatorname{Var}\left(R_t\right)}{\operatorname{Var}\left(S_t+R_t\right)}\right), \]

where \(R_t\) is the remainder component:

t <- toronto %>% features(cases, feat_stl)

t(t[1:2])## [,1]

## trend_strength 0.9843102

## seasonal_strength_week 0.5142436Relative to \(F_{Trend}\), the seasonality is not robust in the data. So, our decision is to go with a simple first-differencing with Box-Cox transformation. However, we will look at the final predictive performance if the transformation provides any benefit.

31.5 Modeling ARIMA

In his post, Forecasting COVID-19, Rob J Hyndman makes the following comment in March 2020:

(…) the COVID-19 pandemic, it is easy to see why forecasting its effect is difficult. While we have a good understanding of how it works in terms of person-to-person infections, we have limited and misleading data. The current numbers of confirmed cases are known to be vastly underestimated due to the limited testing available. There are almost certainly many more cases of COVID-19 that have not been diagnosed than those that have. Also, the level of under-estimation varies enormously between countries. In a country like South Korea with a lot of testing, the numbers of confirmed cases are going to be closer to the numbers of actual cases than in the US where there has been much less testing. So we simply cannot easily model the spread of the pandemic using the data that is available.

The second problem is that the forecasts of COVID-19 can affect the thing we are trying to forecast because governments are reacting, some better than others. A simple model using the available data will be misleading unless it can incorporate the various steps being taken to slow transmission.

In summary, fitting simple models to the available data is pointless, misleading and dangerous.

With our selection of the data, we do not intent to create another debate on forecasting COVID-19. There are hundreds of different forecasting models currently operational in a hub, The COVID-19 Forecast Hub, that can be used live. We will start with an automated algorithm ARIMA() that will allow a seasonal parameters:

\[ \text { ARIMA }(p, d, q) \times(P, D, Q) S \]

The first term is the non-seasonal part of ARIMA with \(p=\) AR order, \(d=\) non-seasonal differencing, \(q=\) MA order. The secon term is seasonal part of the model with \(P=\) seasonal AR order, \(D=\) seasonal differencing, \(Q\) = seasonal MA order, and \(S=\) seasonal pattern, which defines the number of time periods until the pattern repeats again.

In our case, low values tend always to occur in some particular days, Sundays. Therefore, we may think that \(\mathrm{S}=7\) is the span of the periodic seasonal behavior in our data. We can think of a seasonal first order autoregressive model, AR(1), would use \(X_{t-7}\) to predict \(X_t\). Likewise, a seasonal second order autoregressive model would use \(X_{t-7}\) and \(X_{t-14}\) to predict \(X_t\). A seasonal first order MA(1) model would use \(\epsilon_{t-7}\) as a predictor. A seasonal second order MA(2) model would use \(\epsilon_{t-7}\) and \(\epsilon_{t-14}\).

Let’s use our data first-differenced and transformed:

toronto <- toronto %>%

mutate(boxcases = box_cox(cases, lambda = lmbd))

toronto %>%

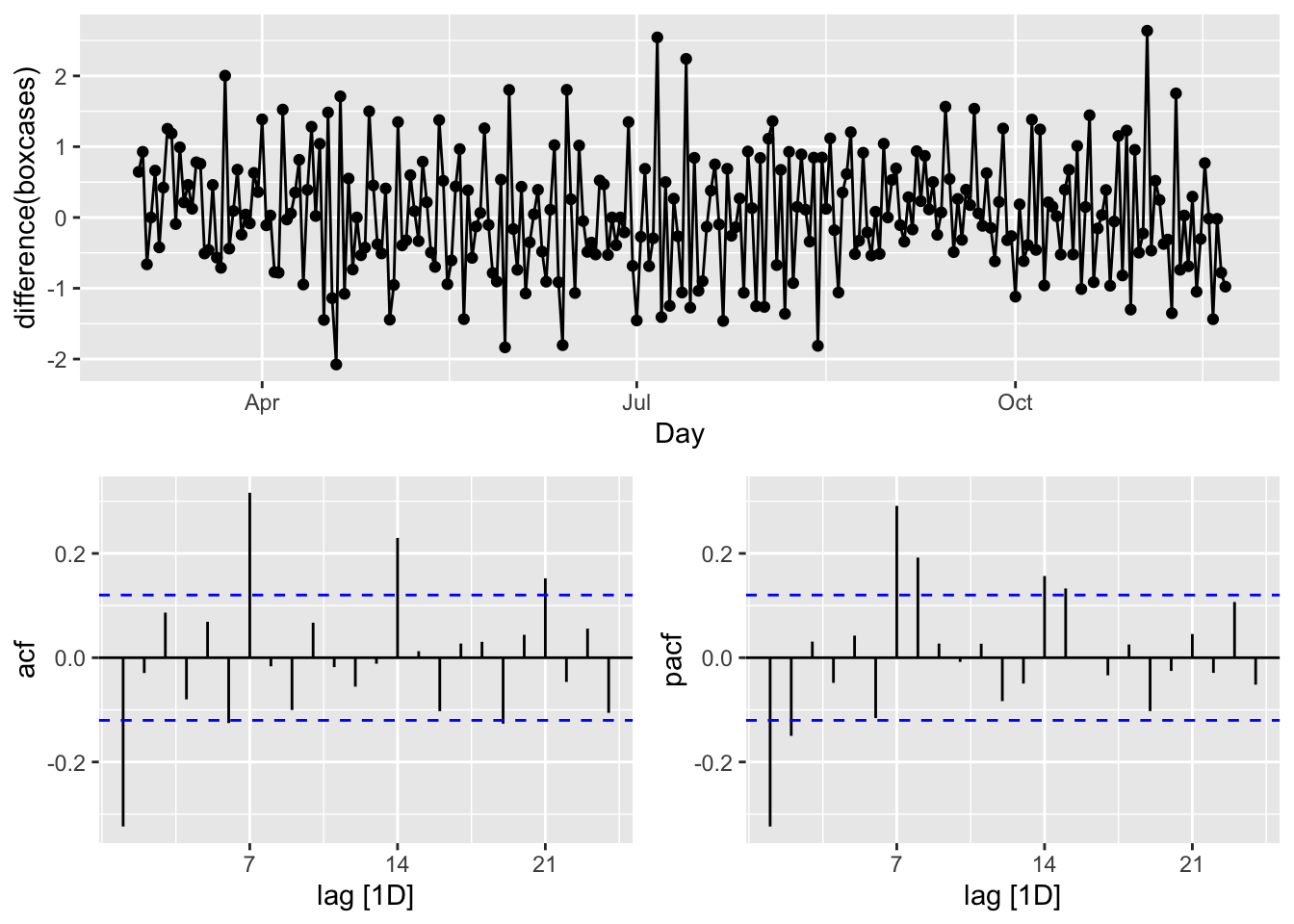

gg_tsdisplay(difference(boxcases), plot_type='partial')

We look at the spikes and decays in ACF and PACF: a exponential decay in ACF is observed at seasonal spikes of 7, 14, and 21 as well as two spikes at 7 and 14 in PACF indicate seasonal AR(2) We will also add non-seasonal AR(2) due to 2 spikes in PACF at days 1 and 2. Here are our initial models:

\[ \operatorname{ARIMA}(2,1,0)(2,1,0)_{7}\\ \operatorname{ARIMA}(0,1,2)(0,1,3)_{7} \]

covfit <- toronto %>%

model(AR2 = ARIMA(boxcases ~ pdq(2,1,0) + PDQ(3,1,0)),

MA3 = ARIMA(boxcases ~ pdq(0,1,2) + PDQ(0,1,3)),

auto = ARIMA(boxcases, stepwise=FALSE, approx=FALSE))

t(cbind("AR2" = covfit$AR2,

"MA3" = covfit$MA3,

"auto" = covfit$auto)) ## [,1]

## AR2 ARIMA(2,1,0)(3,1,0)[7]

## MA3 ARIMA(0,1,2)(0,1,3)[7]

## auto ARIMA(2,1,1)(2,0,0)[7]glance(covfit) %>% arrange(AICc) %>% dplyr::select(.model:BIC)## # A tibble: 3 × 6

## .model sigma2 log_lik AIC AICc BIC

## <chr> <dbl> <dbl> <dbl> <dbl> <dbl>

## 1 MA3 0.468 -277. 567. 567. 588.

## 2 AR2 0.534 -285. 582. 583. 604.

## 3 auto 0.525 -289. 590. 591. 612.covfit %>% dplyr::select(MA3) %>% report()## Series: boxcases

## Model: ARIMA(0,1,2)(0,1,3)[7]

##

## Coefficients:

## ma1 ma2 sma1 sma2 sma3

## -0.4340 0.1330 -0.8617 -0.0573 -0.0809

## s.e. 0.0648 0.0612 0.0827 0.0733 0.0600

##

## sigma^2 estimated as 0.4684: log likelihood=-277.29

## AIC=566.58 AICc=566.92 BIC=587.9The ARIMA() function uses unitroot_nsdiffs() to determine \(D\) when it is not specified. Earlier, we run this function that suggested no seasonal differencing. All other parameters are determined by minimizing the AICc.

AICc (Akaike’s Information Criterion with a correction for finite sample sizes) is similar to Akaike’s Information Criterion (AIC), but it includes a correction factor to account for the fact that the sample size may be small relative to the number of parameters in the model. This correction helps to reduce the bias in the AIC estimate and make it more accurate for small sample sizes. When the sample size is large, AIC and AICc are nearly equivalent and either one can be used.

Although AICc values across the models are not comparable (for “auto”, as it has no seasonal differencing), it seems that our manually constructed ARIMA, \(\operatorname{ARIMA}(0,1,2)(0,1,3)_{7}\) could also be an option. This brings the possibility of a grid search to our attention.

Let’s check their residuals:

rbind(augment(covfit) %>%

filter(.model == "auto") %>%

features(.innov, ljung_box, lag=24, dof=5),

augment(covfit) %>%

filter(.model == "MA3") %>%

features(.innov, ljung_box, lag=24, dof=5),

augment(covfit) %>%

filter(.model == "AR2") %>%

features(.innov, ljung_box, lag=24, dof=5))## # A tibble: 3 × 3

## .model lb_stat lb_pvalue

## <chr> <dbl> <dbl>

## 1 auto 19.0 0.459

## 2 MA3 27.3 0.0971

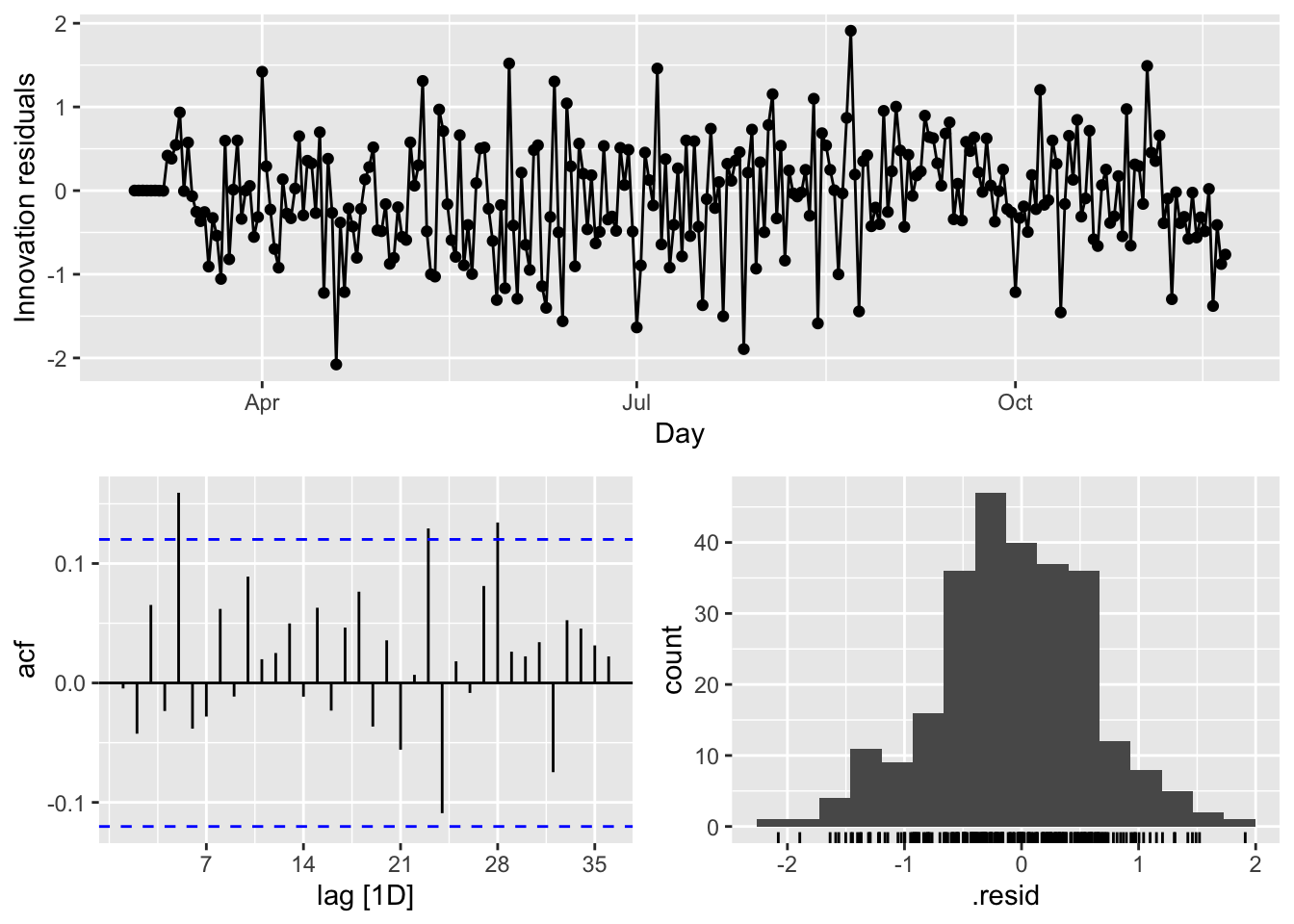

## 3 AR2 21.1 0.331covfit %>%dplyr::select(MA3) %>% gg_tsresiduals(lag=36)

There are several significant spikes in the ACF. But, the model passes the Ljung-Box test at the 5 percent significance level. Meanwhile, a model can still be used for forecasting, but the prediction intervals may not be accurate due to the correlated residuals. Sometimes it is possible that we cannot find a model that passes this test. In practice, we may have to look at the tradeoff between prediction accuracy and and reliable confidence intervals. If the difference is too high, we may chose the best model with the highest prediction accuracy.

Before looking at a cross-validation approach for model selection in ARIMA modeling, let use our model to predict a week ahead (2020-11-22 to 2020-11-28):

fc <- covfit %>%

forecast(h = 7)

fc## # A fable: 21 x 4 [1D]

## # Key: .model [3]

## .model Day boxcases .mean

## <chr> <date> <dist> <dbl>

## 1 AR2 2020-11-22 N(12, 0.53) 12.1

## 2 AR2 2020-11-23 N(13, 0.68) 13.3

## 3 AR2 2020-11-24 N(13, 0.87) 12.8

## 4 AR2 2020-11-25 N(13, 1.1) 12.8

## 5 AR2 2020-11-26 N(12, 1.3) 12.2

## 6 AR2 2020-11-27 N(12, 1.5) 12.3

## 7 AR2 2020-11-28 N(12, 1.7) 11.5

## 8 MA3 2020-11-22 N(12, 0.48) 12.4

## 9 MA3 2020-11-23 N(13, 0.63) 13.2

## 10 MA3 2020-11-24 N(13, 0.87) 13.1

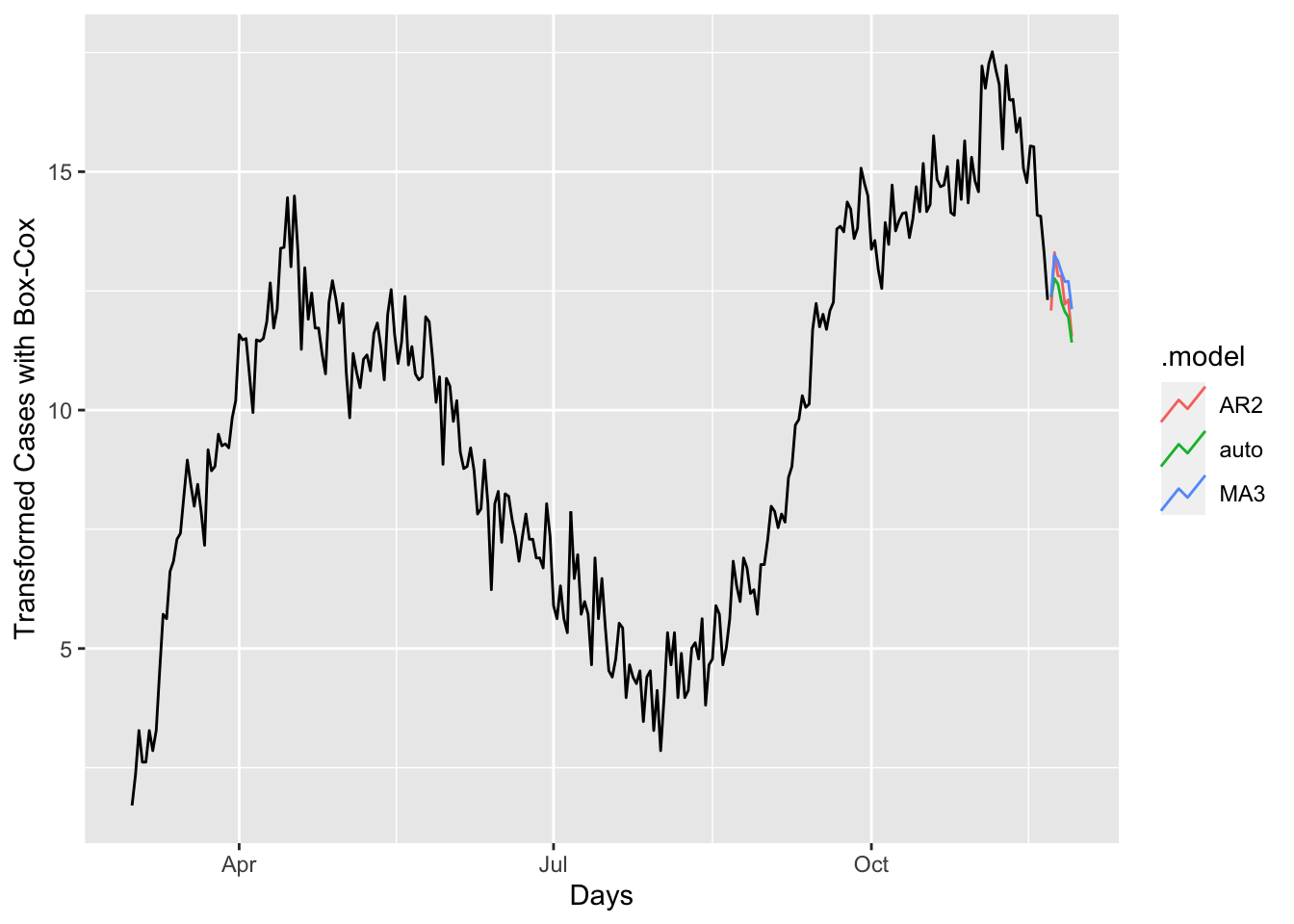

## # … with 11 more rowsfc %>%

autoplot(toronto, level = NULL) +

xlab("Days") + ylab("Transformed Cases with Box-Cox")

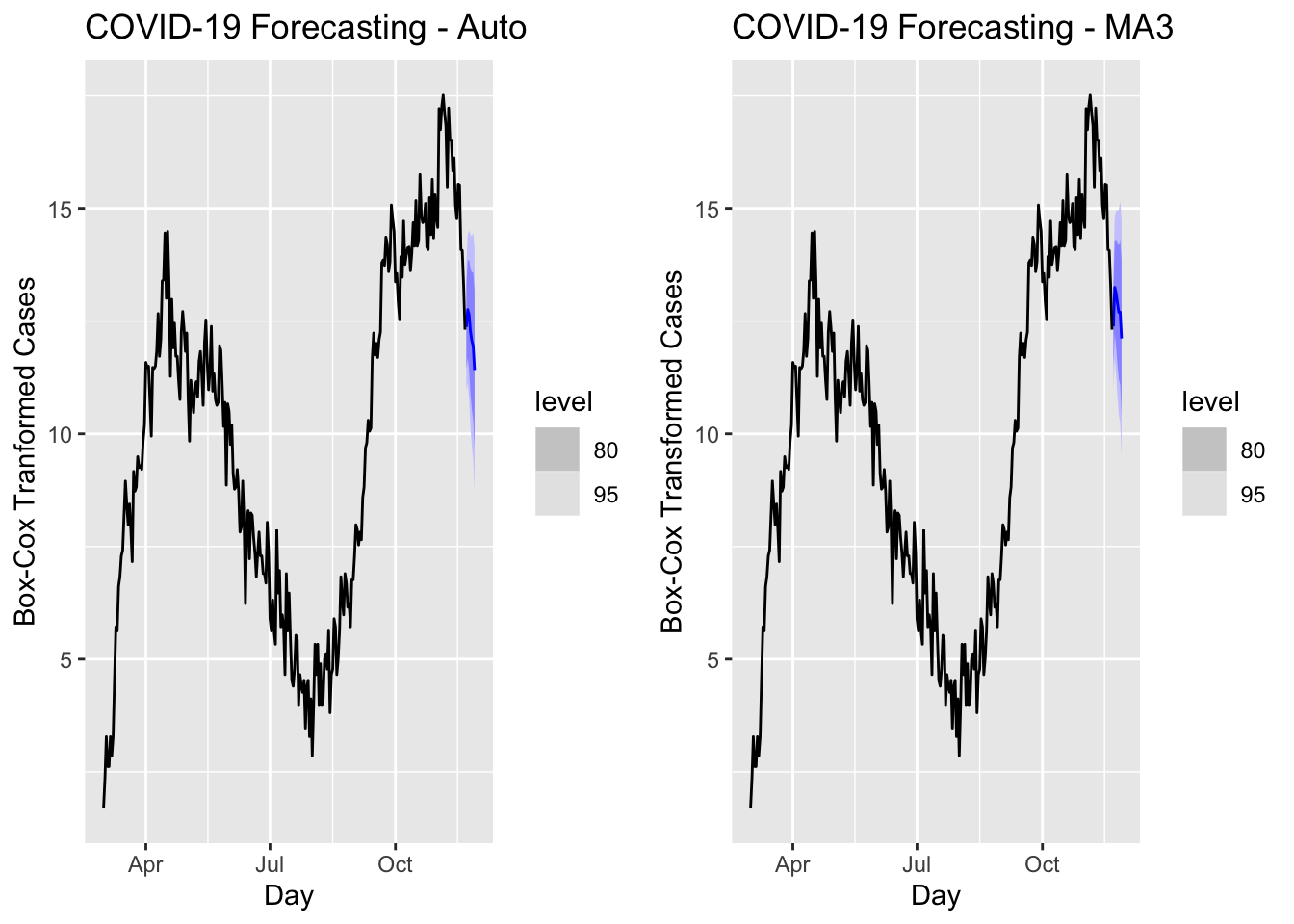

a <- forecast(covfit, h=7) %>%

filter(.model=='auto') %>%

autoplot(toronto) +

labs(title = "COVID-19 Forecasting - Auto",

y="Box-Cox Tranformed Cases")

b <- forecast(covfit, h=7) %>%

filter(.model=='MA3') %>%

autoplot(toronto) +

labs(title = "COVID-19 Forecasting - MA3",

y="Box-Cox Transformed Cases")

require(gridExtra)

grid.arrange(a, b, ncol=2)

We have predicted values for coming 7 days but we do not have realized values. Hence, we cannot compare these models in terms of their accuracy. We now look at the forecast accuracy of these models by using a training set containing all data up to 2020-11-14. We then forecast the remaining seven days in the data set and compare the results with the actual values.

train <- toronto %>%

filter_index(~ "2020-11-14")

fit <- train %>%

model(

AR2 = ARIMA(boxcases ~ pdq(2,1,0) + PDQ(3,1,0)),

MA3 = ARIMA(boxcases ~ pdq(0,1,2) + PDQ(0,1,3)),

auto = ARIMA(boxcases, stepwise=FALSE, approx=FALSE)

) %>%

mutate(mixed = (auto + AR2 + MA3) / 3)And, now the accuracy measures:

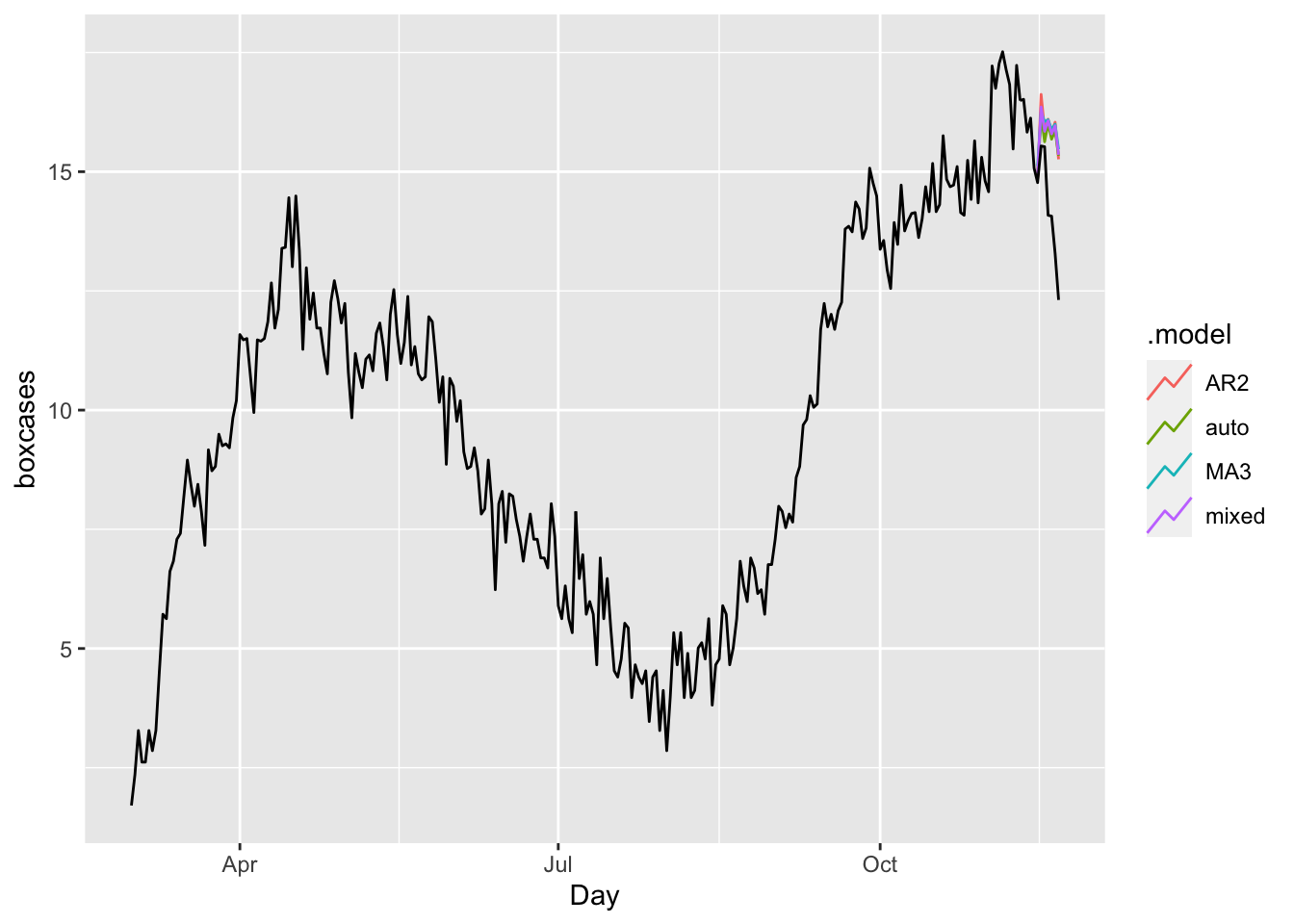

fc <- fit %>% forecast(h = 7)

fc %>%

autoplot(toronto, level = NULL)

accuracy(fc, toronto)## # A tibble: 4 × 10

## .model .type ME RMSE MAE MPE MAPE MASE RMSSE ACF1

## <chr> <chr> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl>

## 1 AR2 Test -1.57 1.88 1.57 -11.6 11.6 1.35 1.30 0.359

## 2 auto Test -1.43 1.79 1.43 -10.7 10.7 1.23 1.24 0.428

## 3 MA3 Test -1.61 1.91 1.61 -11.9 11.9 1.38 1.32 0.501

## 4 mixed Test -1.54 1.86 1.54 -11.4 11.4 1.32 1.28 0.436In all measures, the model “auto” (ARIMA with the Hyndman-Khandakar algorithm) is better than others. Although mixing several different ARIMA models does not make sense, we can have an ensemble forecast mixing several different time series models in addition ARIMA modeling. A nice discussion can be found in this post at Stackoverflow.

Finally, it is always good to check ARIMA (or any time series forecasting) against the base benchmark.

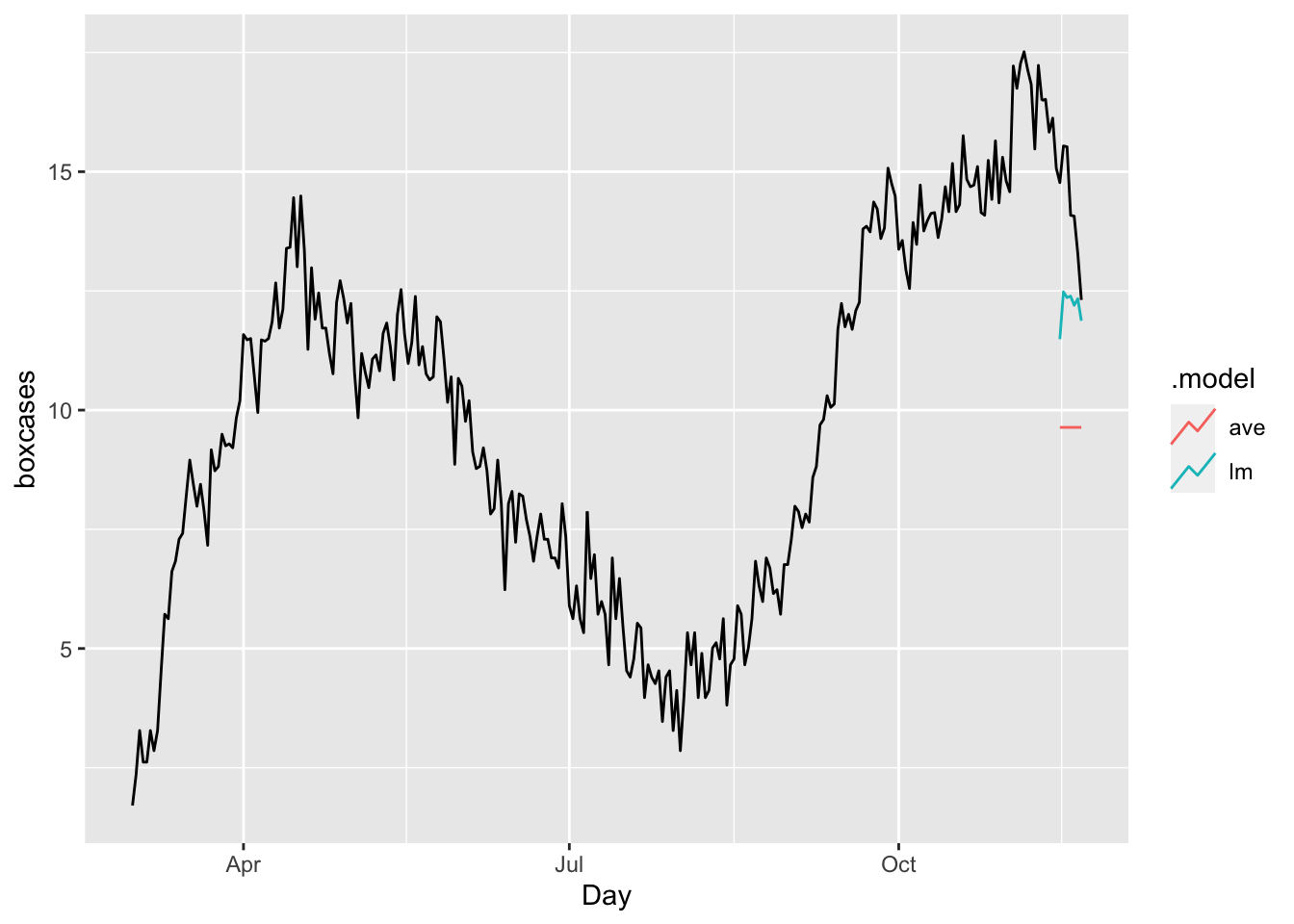

bfit <- train %>%

model(

ave = MEAN(boxcases),

lm = TSLM(boxcases ~ trend()+season())

)

bfc <- bfit %>% forecast(h = 7)

bfc %>%

autoplot(toronto, level = NULL)

accuracy(bfc, toronto)## # A tibble: 2 × 10

## .model .type ME RMSE MAE MPE MAPE MASE RMSSE ACF1

## <chr> <chr> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl>

## 1 ave Test 4.59 4.72 4.59 31.8 31.8 3.94 3.26 0.507

## 2 lm Test 2.07 2.32 2.07 14.1 14.1 1.77 1.60 0.516The results shows our ARIMA model is doing much better job relative to a time-series linear model or a simple average

As we discussed earlier in this book, there are basically two ways to select a best fitting predictive model: ex-post and ex-ante tools to penalize the overfitting. With AIC (Akaike Information Criterion) and BIC (Bayesian Information Criteria) measures, we can indirectly estimate the test (out-of-sample) error by making an adjustment to the training (in-sample) error to account for the bias due to overfitting. Therefore, these methods are ex-post tools to penalize the overfitting. The Hyndman-Khandakar algorithm uses this ex-post approach by selecting the best predictive ARIMA model with minimum AICc among alternatives.

We can directly estimate the test error (out-sample) and choose the model that minimizes it. Instead of selecting a model with AICc, we can do it by tuning the parameters of ARIMA with a cross-validation approach so that the tuned model achieves the highest predictive accuracy.