Chapter 17 Ridge

We know that the least squares fitting procedure is that one estimates \(\beta_{0}, \beta_{1}, \ldots, \beta_{p}\) that minimize the residual sum of squares:

\[ \mathrm{RSS}=\sum_{i=1}^{n}\left(y_{i}-\beta_{0}-\sum_{j=1}^{p} \beta_{j} x_{i j}\right)^{2} \] Ridge regression is very similar to least squares, except that the coefficients are estimated by minimizing a slightly different quantity.

\[ \sum_{i=1}^{n}\left(y_{i}-\beta_{0}-\sum_{j=1}^{p} \beta_{j} x_{i j}\right)^{2}+\lambda \sum_{j=1}^{p} \beta_{j}^{2} =\mathrm{RSS}+\lambda \sum_{j=1}^{p} \beta_{j}^{2}, \]

where \(\lambda\) is the hyperparameter that can be tuned by cross-validation and grid search. The last term, \(\lambda \sum_{j} \beta_{j}^{2}\), is a constraint, which is also called shrinkage penalty. This type of penalty is called as \(\ell_{2}\). As with Ordinary Least Squares (OLS), this cost function tries to minimize RSS but also penalizes the size of the coefficients.

More specifically,

\[ \hat{\beta}_\lambda^{\text {ridge }}=\operatorname{argmin}\left\{\left\|\mathbf{y}-\left(\beta_0+\mathbf{X} \beta\right)\right\|_{\ell_2}^2+\lambda\|\beta\|_{\ell_2}^2\right\} \]

Explicit solution:

\[ \hat{\beta}_\lambda=\left(\mathbf{X}^{\top} \mathbf{X}+\lambda \mathbf{I}\right)^{-1} \mathbf{X}^{\top} \mathbf{y} \]

where,

- If \(\lambda \rightarrow 0, \quad \hat{\beta}_0^{\text {ridge }}=\hat{\beta}^{\text {ols }}\),

- If \(\lambda \rightarrow \infty, \quad \hat{\beta}_{\infty}^{\text {ridge }}=\mathbf{0}\).

The hyperparameter \(\lambda\) controls the relative impact of the penalization on the regression coefficient estimates. When \(\lambda = 0\), the cost function becomes RSS, that is the cost function of OLS and the estimations produce the least squares estimates. However, as \(\lambda\) gets higher, the impact of the shrinkage penalty grows, and the coefficients of the ridge regression will approach zero. Note that, the shrinkage penalty is applied to slope coefficients not to the intercept, which is simply a measure of the mean value of the response, when all features are zero.

Lets apply this to the same data we used earlier, Hitters from the ISLR (ISLR 2021b) package:

library(ISLR)

remove(list = ls())

data(Hitters)

df <- Hitters[complete.cases(Hitters$Salary), ]We will use glmnet to fit a ridge regression. The generic function in glmnet is defined by

\[

\min _{\beta_0, \beta} \frac{1}{N} \sum_{i=1}^N w_i l\left(y_i, \beta_0+\beta^T x_i\right)+\lambda\left[(1-\alpha)\|\beta\|_2^2 / 2+\alpha\|\beta\|_1\right] \text {, }

\]

where \(l\left(y_i, \eta_i\right)\) is the negative log-likelihood contribution for observation \(i\) and \(\alpha\) is the elastic net penalty: lasso regression ( \(\alpha=1\), the default) and ridge regression \((\alpha=0)\). As before, the tuning parameter \(\lambda\) controls the overall strength of the penalty. Since the penalty shrinks (ridge) the coefficients of correlated variables or pick one of them and discard the others (lasso), the variables are supposed to be standardized, which is done by glmnet.

This function has slightly different syntax from other model-fitting functions that we have used so far in this book, such as the y ~ X syntax. Therefore, before we execute the syntax, we have the prepare the model so that X will be a matrix and y will be vector. The matrix X has to be prepared before we proceed, which must be free of NAs.

X <- model.matrix(Salary~., df)[,-1]

y <- df$SalaryThe glmnet package is maintained by Trevor Hastie who provides a friendly vignette (Hastie, Qian, and Tay 2021). They describe the importance of model.matrix() in glmnet as follows:

(…)particularly useful for creating \(x\); not only does it produce a matrix corresponding to the 19 predictors but it also automatically transforms any qualitative variables into dummy variables. The latter property is important because

glmnet()can only take numerical, quantitative inputs.

Here is the example for a ridge regression:

library(glmnet)

grid = 10^seq(10, -2, length = 100)

model <- glmnet(X, y, alpha = 0, lambda = grid)Although we defined the grid, we did not do a grid search explicitly by cross validation. By default, the glmnet() function performs ridge regression for an automatically selected range of \(\lambda\) values. It ranges from the null model - only intercept when \(\lambda\) is at the upper bound and the least squares fit when the \(\lambda\) is at lower bound. The application above is to show that we can also choose to implement the function over a grid of values. Moreover, the glmnet() function standardizes the variables so that they are on the same scale. To turn off this default setting, use the argument standardize=FALSE.

The methods here, ridge and lasso, are parametric models. Unlike non-parametric methods, each model is defined by a set of parameters or, as in our case, coefficients. Therefore, when we do a grid search, each value of the hyperparameter (\(\lambda\)) is associated with one model defined by a set of coefficients. In order to see the coefficients we need to apply another function, coef(). Remember, we have 100 \(\lambda's\). Hence, coef() produces a 20 x 100 matrix, with 20 rows (one for each predictor, plus an intercept) and 100 columns (one for each value of \(\lambda\)).

dim(coef(model))## [1] 20 100model$lambda[c(20,80)]## [1] 4.977024e+07 2.656088e+00coef(model)[, c(20,80)]## 20 x 2 sparse Matrix of class "dgCMatrix"

## s19 s79

## (Intercept) 5.358880e+02 156.6073700

## AtBat 1.093664e-05 -1.7526436

## Hits 3.967221e-05 6.1739859

## HmRun 1.598556e-04 1.3285278

## Runs 6.708833e-05 -0.7689372

## RBI 7.086606e-05 -0.1297830

## Walks 8.340541e-05 5.5357165

## Years 3.410894e-04 -9.2923000

## CAtBat 9.390097e-07 -0.0792321

## CHits 3.455823e-06 0.2132942

## CHmRun 2.606160e-05 0.6557328

## CRuns 6.933126e-06 0.8349167

## CRBI 7.155123e-06 0.4090719

## CWalks 7.570013e-06 -0.6623253

## LeagueN -1.164983e-04 62.0427219

## DivisionW -1.568625e-03 -121.5286522

## PutOuts 4.380543e-06 0.2809457

## Assists 7.154972e-07 0.3124435

## Errors -3.336588e-06 -3.6852362

## NewLeagueN -2.312257e-05 -27.9849755Due to the penalty, we see that the coefficient estimates are much smaller, when a large value of \(\lambda\) is used.

We generally use the predict() function as before. But, here we can also use it to estimate the ridge regression coefficients for a new value of \(\lambda\). Hence, if we don’t want to rely on the internal grid search provided by glmnet(), we can do our own grid search by predict(). This is an example when \(\lambda = 50\), which wasn’t in the grid.

predict(model, s = 50, type = "coefficients")## 20 x 1 sparse Matrix of class "dgCMatrix"

## s1

## (Intercept) 4.876610e+01

## AtBat -3.580999e-01

## Hits 1.969359e+00

## HmRun -1.278248e+00

## Runs 1.145892e+00

## RBI 8.038292e-01

## Walks 2.716186e+00

## Years -6.218319e+00

## CAtBat 5.447837e-03

## CHits 1.064895e-01

## CHmRun 6.244860e-01

## CRuns 2.214985e-01

## CRBI 2.186914e-01

## CWalks -1.500245e-01

## LeagueN 4.592589e+01

## DivisionW -1.182011e+02

## PutOuts 2.502322e-01

## Assists 1.215665e-01

## Errors -3.278600e+00

## NewLeagueN -9.496680e+00There are two ways that we can train ridge (and Lasso):

- Use our own training algorithm;

- Rely on

'glmnetinternal cross-validation process.

Here is an example for our own training algorithm for training ridge regression:

grid = 10^seq(10, -2, length = 100)

MSPE <- c()

MMSPE <- c()

for(i in 1:length(grid)){

for(j in 1:100){

set.seed(j)

ind <- unique(sample(nrow(df), nrow(df), replace = TRUE))

train <- df[ind, ]

xtrain <- model.matrix(Salary~., train)[,-1]

ytrain <- df[ind, "Salary"]

test <- df[-ind, ]

xtest <- model.matrix(Salary~., test)[,-1]

ytest <- df[-ind, "Salary"]

model <- glmnet(xtrain, ytrain, alpha = 0, lambda = grid[i], thresh = 1e-12)

yhat <- predict(model, s = grid[i], newx = xtest)

MSPE[j] <- mean((yhat - ytest)^2)

}

MMSPE[i] <- mean(MSPE)

}

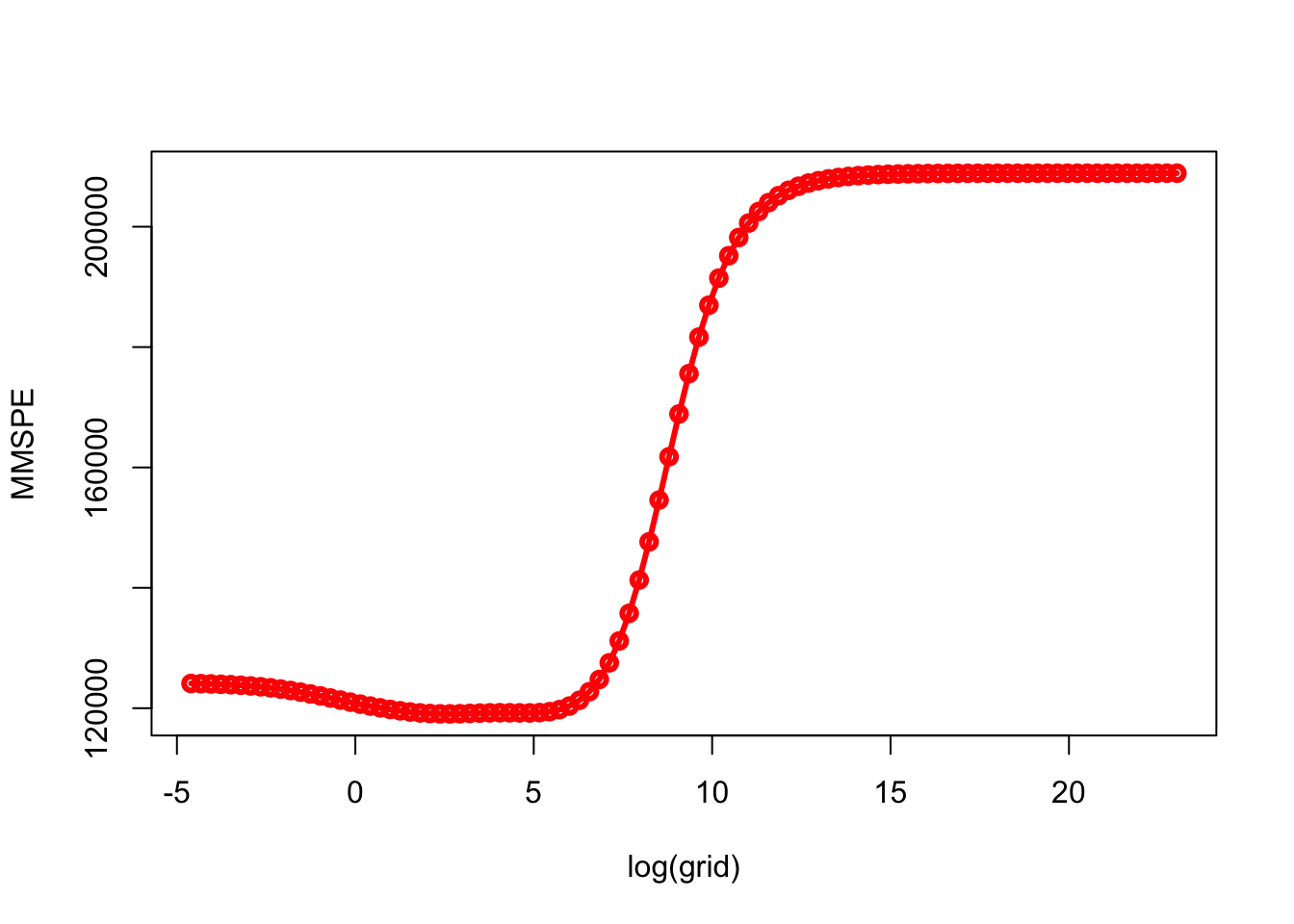

min(MMSPE)## [1] 119058.3grid[which.min(MMSPE)]## [1] 14.17474plot(log(grid), MMSPE, type="o", col = "red", lwd = 3)

What is the tuned model using the last training test with this \(\lambda\)?

lambda <- grid[which.min(MMSPE)]

coeff <- predict(model, s = lambda , type = "coefficients", newx = xtrain)

coeff## 20 x 1 sparse Matrix of class "dgCMatrix"

## s1

## (Intercept) 285.78834247

## AtBat -1.27240085

## Hits 2.06931134

## HmRun 0.04319066

## Runs 2.75588969

## RBI 0.45631590

## Walks 3.46189297

## Years -8.82528502

## CAtBat -0.26127780

## CHits 1.28540111

## CHmRun 1.31904979

## CRuns 0.05880843

## CRBI -0.05103190

## CWalks -0.34003983

## LeagueN 131.98795986

## DivisionW -119.25402540

## PutOuts 0.19785230

## Assists 0.64820842

## Errors -6.97397640

## NewLeagueN -54.55149894We may want to compare the ridge with a simple OLS:

MSPE <- c()

for(j in 1:100){

set.seed(j)

ind <- unique(sample(nrow(df), nrow(df), replace = TRUE))

train <- df[ind, ]

test <- df[-ind,]

model <- lm(Salary~., data = train)

yhat <- predict(model, newdata = test)

MSPE[j] <- mean((yhat - test$Salary)^2)

}

mean(MSPE)## [1] 124217.3summary(model)##

## Call:

## lm(formula = Salary ~ ., data = train)

##

## Residuals:

## Min 1Q Median 3Q Max

## -715.51 -187.40 -32.85 148.29 1686.38

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) 285.95478 126.06479 2.268 0.0248 *

## AtBat -1.26497 0.94674 -1.336 0.1837

## Hits 2.02174 3.61275 0.560 0.5766

## HmRun -0.01383 8.03787 -0.002 0.9986

## Runs 2.79786 4.23051 0.661 0.5095

## RBI 0.47768 3.56888 0.134 0.8937

## Walks 3.44099 2.57671 1.335 0.1839

## Years -8.76533 17.25334 -0.508 0.6122

## CAtBat -0.26610 0.20435 -1.302 0.1950

## CHits 1.31361 1.09982 1.194 0.2343

## CHmRun 1.35851 2.30018 0.591 0.5557

## CRuns 0.04142 1.02393 0.040 0.9678

## CRBI -0.06982 1.08722 -0.064 0.9489

## CWalks -0.33312 0.45479 -0.732 0.4651

## LeagueN 132.36961 113.39037 1.167 0.2450

## DivisionW -119.16837 56.96453 -2.092 0.0382 *

## PutOuts 0.19795 0.10911 1.814 0.0718 .

## Assists 0.64902 0.29986 2.164 0.0321 *

## Errors -6.97871 5.97011 -1.169 0.2444

## NewLeagueN -54.96821 111.81338 -0.492 0.6238

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 335.6 on 140 degrees of freedom

## Multiple R-squared: 0.4428, Adjusted R-squared: 0.3672

## F-statistic: 5.856 on 19 and 140 DF, p-value: 1.346e-10The second way is to rely on the glmnet internal training process, cv.glmnet, which is the main function to do cross-validation along with various supporting methods such as plotting and prediction. A part of the following scripts follows the same algorithm as the one in the book (Introduction to Statistical Learning - ISLR p.254). This approach uses a specific grid on \(\lambda\).

# With a defined grid on lambda

bestlam <- c()

mse <- c()

grid = 10^seq(10, -2, length = 100)

for(i in 1:100){

set.seed(i)

train <- sample(1:nrow(X), nrow(X)*0.5) # 50% split

test <- c(-train)

ytest <- y[test]

#finding lambda

cv.out <- cv.glmnet(X[train,], y[train], alpha = 0)

bestlam[i] <- cv.out$lambda.min

#Predicting with that lambda

ridge.mod <- glmnet(X[train,], y[train], alpha = 0,

lambda = grid, thresh = 1e-12)

yhat <- predict(ridge.mod, s = bestlam[i], newx = X[test,])

mse[i] <- mean((yhat - ytest)^2)

}

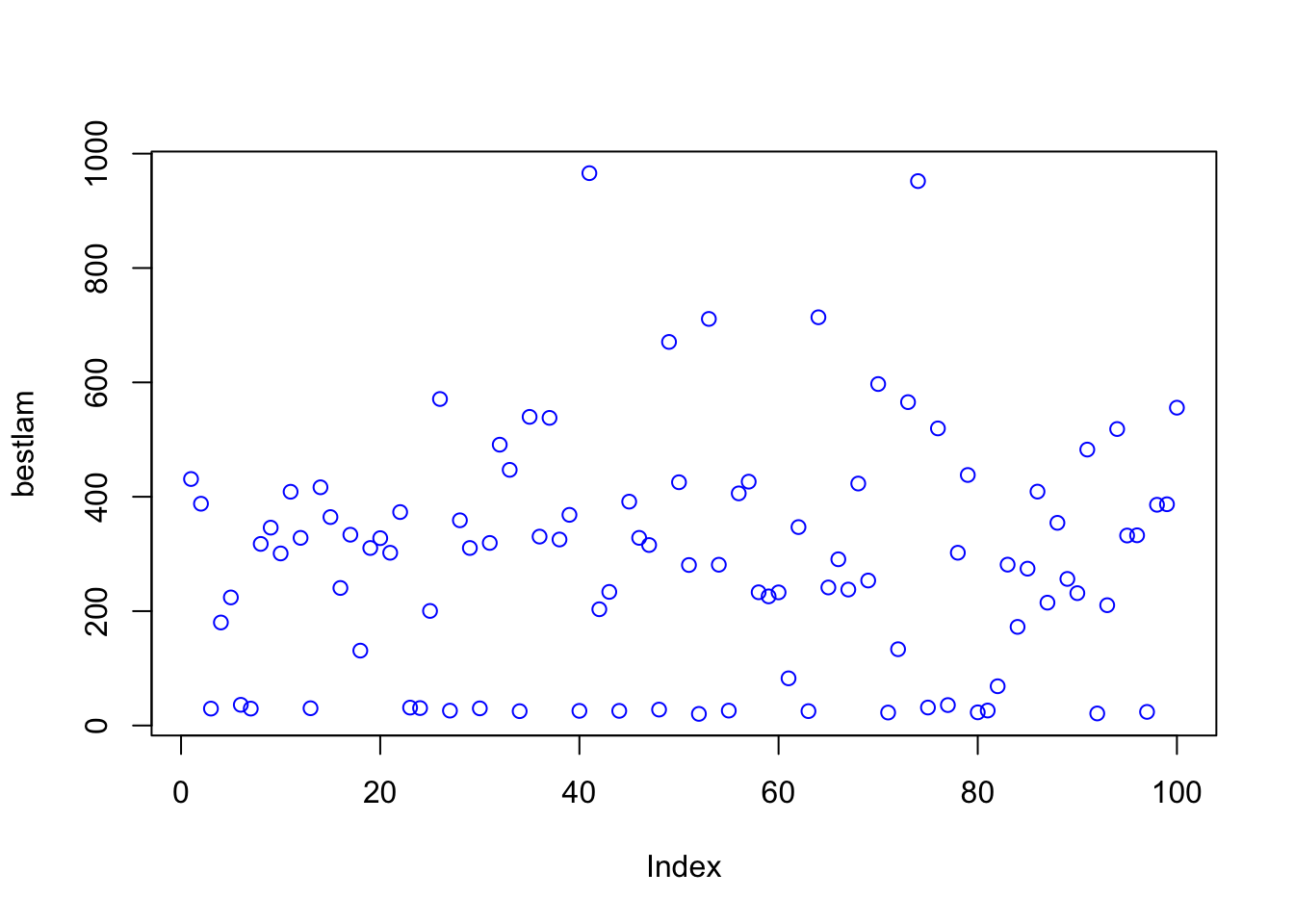

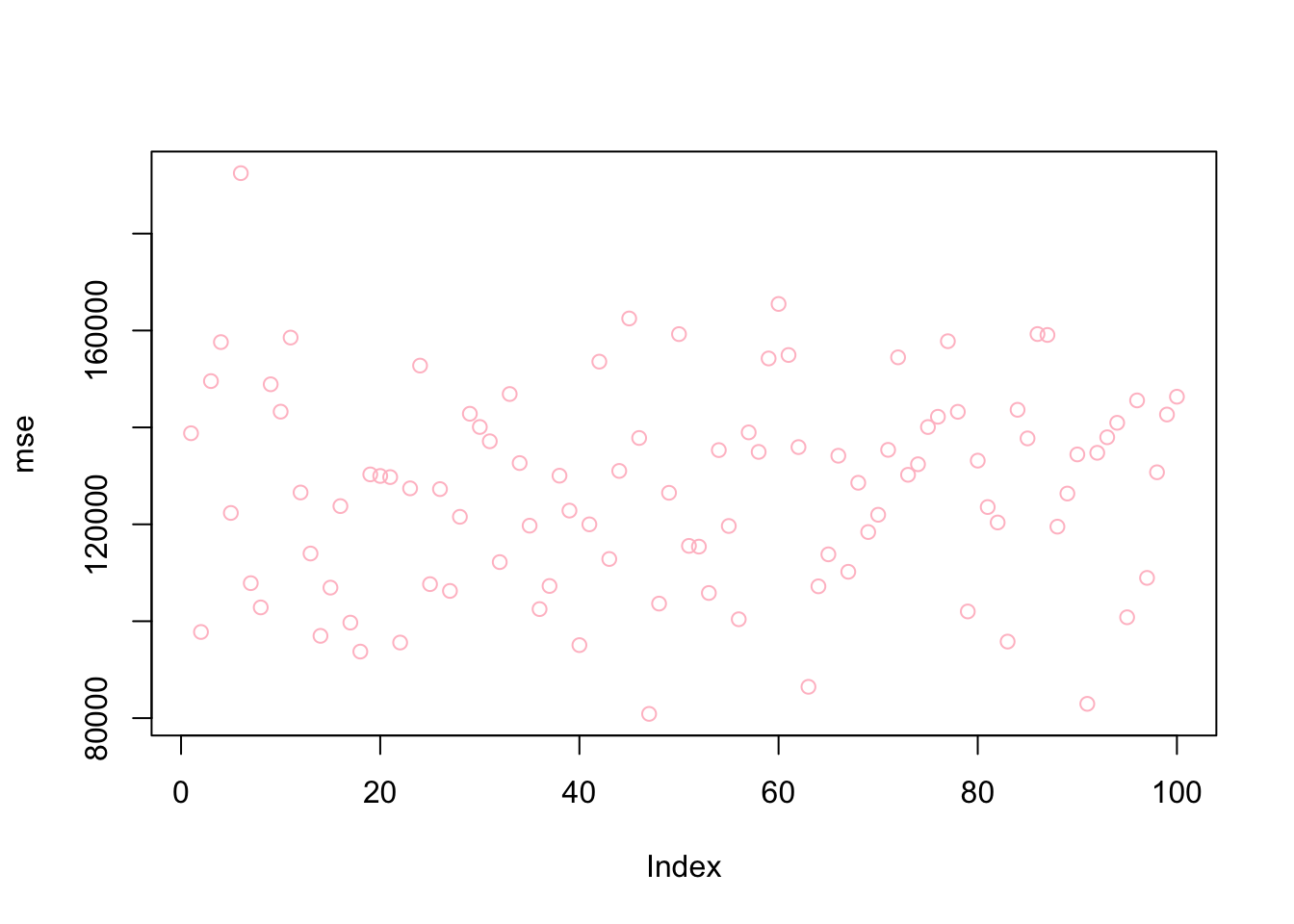

mean(bestlam)## [1] 290.227mean(mse)## [1] 127472.6plot(bestlam, col = "blue")

plot(mse, col = "pink")

Now the same application without a specific grid:

bestlam <- c()

mse <- c()

# Without a pre-defined grid on lambda

for(i in 1:100){

set.seed(i)

train <- sample(1:nrow(X), nrow(X)*0.5) # arbitrary split

test <- c(-train)

ytest <- y[test]

cv.out <- cv.glmnet(X[train,], y[train], alpha = 0)

yhat <- predict(cv.out, s = "lambda.min", newx = X[test,])

mse[i] <- mean((yhat - ytest)^2)

}

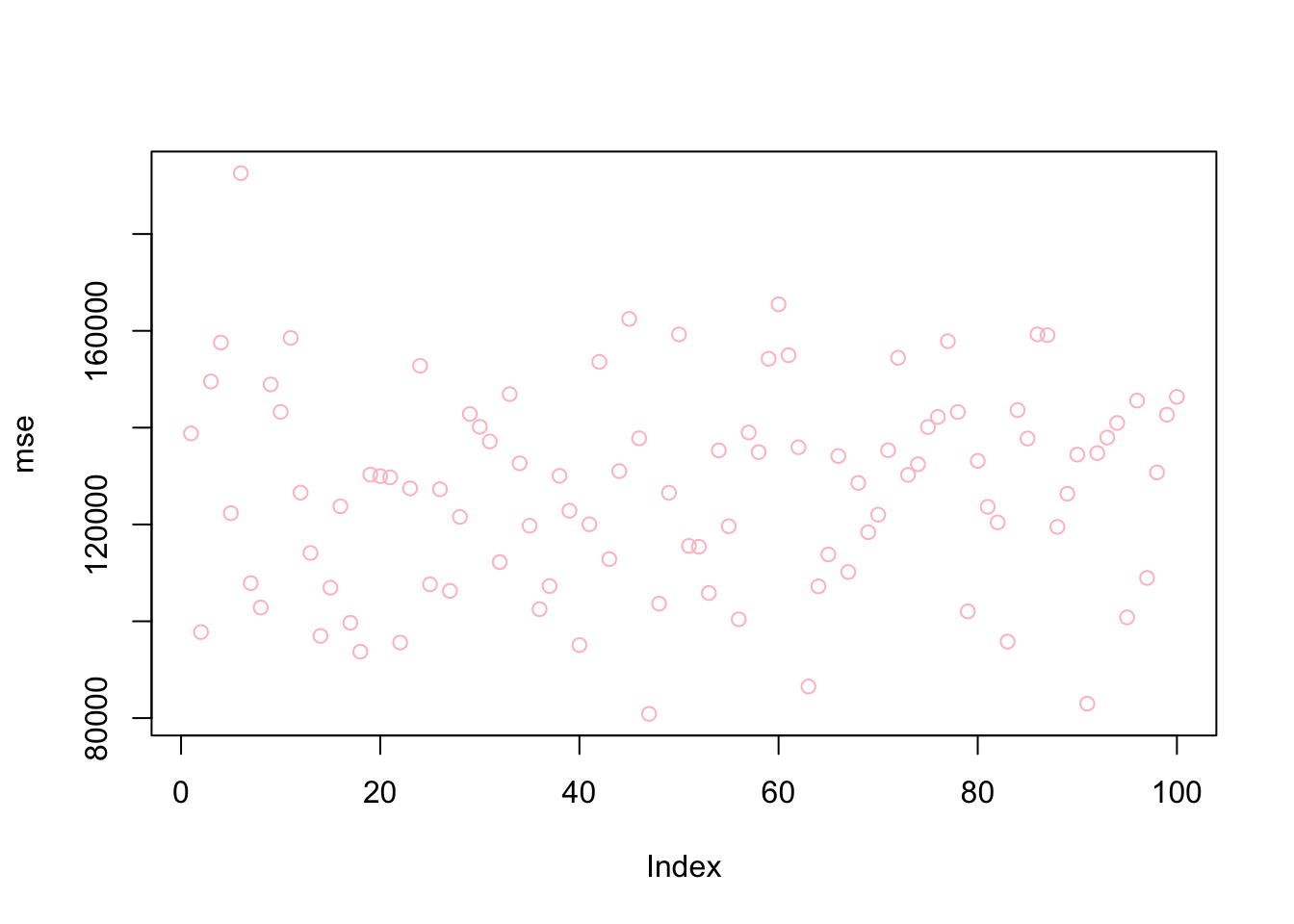

mean(mse)## [1] 127481.6plot(mse, col = "pink")

Ridge regression adds a penalty term that is the sum of the squares of the coefficients of the features in the model. This results in a penalty that is continuous and differentiable, which makes Ridge regression easy to optimize using gradient descent. Ridge regression can be useful when you have a large number of features, and you want to shrink the coefficients of all of the features towards zero, but you still want to keep all of the features in the model. Ridge regression works best in situations where the least squares estimates have high variance.

On the other hand, Lasso (Least Absolute Shrinkage and Selection Operator) adds a penalty term that is the sum of the absolute values of the coefficients of the features in the model. This results in a penalty that is non-differentiable, which makes it more difficult to optimize using gradient descent. However, Lasso has the advantage of being able to set the coefficients of some features to exactly zero, effectively eliminating those features from the model. This can be useful when you have a large number of features, and you want to select a subset of the most important features to include in the model.